Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOne Dump to Crash Them All

Starting on December 3 cryptocurrency crash caused panic on the market. Further Bitcoin movements are foggy, but we can manage to peek behind the crypto market’s curtains and figure out what to do.

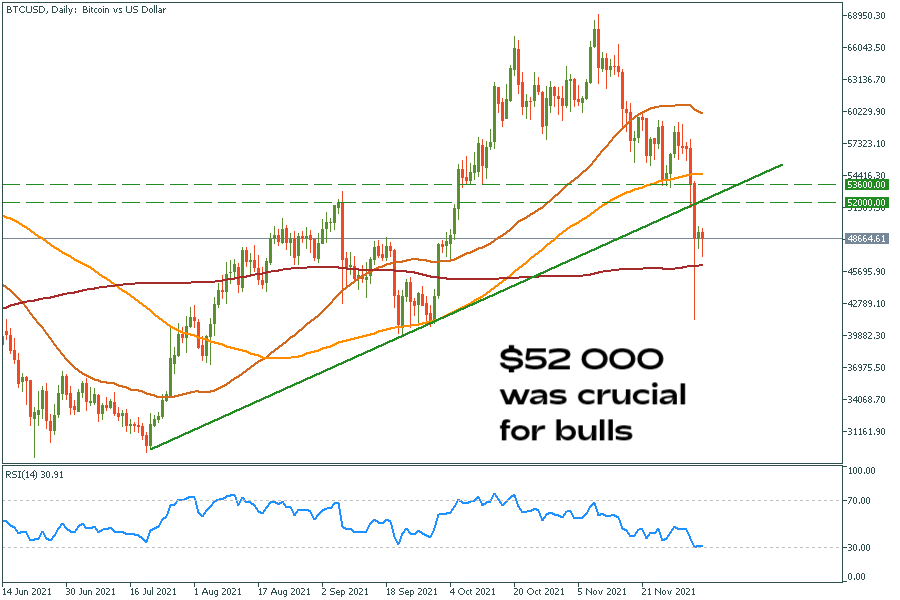

At 17:00, December 3, 2021, the cryptocurrency market has started to fall less than half an hour before opening of the US trading session. At the end of Friday, Bitcoin lost 10% of its capitalization and broke through one of the most critical support areas at $54-53K. Eight hours later, the market has decided to plunge more. In mere hours Bitcoin lost another 20%. Strong buyers’ reactions emerged at $42K. From this level, the main crypto regained 16% in an hour.

According to futures liquidation data, cryptocurrency traders lost more than $2.4 billion in this crash. However, it is still less than $8 billion worth of liquidations in April 2021. How similar or different are these two movements?

One of the most influential cryptocurrency analysts – Willy Woo – supposes that the latest dump was caused partly by spoofers. Cryptocurrency spoofing is the process by which criminals attempt to artificially influence the price of a digital currency by creating fake orders. Spoofing is accomplished by creating the illusion of pessimism (or optimism) in the market. Thus, even the biggest coins (like BTC) can be moved greatly.

But spoofing itself isn’t that powerful. Another reason for a plunge is strong support levels. They are so strong that millions of traders put their stop losses below these lines. And you know what happens when millions of stop losses are executed simultaneously. It’s called “long squeeze”, a short squeeze but in a different direction (Check the article to learn how to trade such events).

There has been enough gunpowder below the $52K level to blow up the market. So the momentum of the movement is understandable. But what now?

As you remember from the beginning, BTC has recovered 16% of the initial dump in half an hour. There are two reasons for that:

Fundamentally, we need to wait for more USDT to come and for Bitcoin reserves to decrease on spot exchanges. This way, we will get the much-needed support for further growth. But what do we see from the technical side? Is this the end of the bull market?

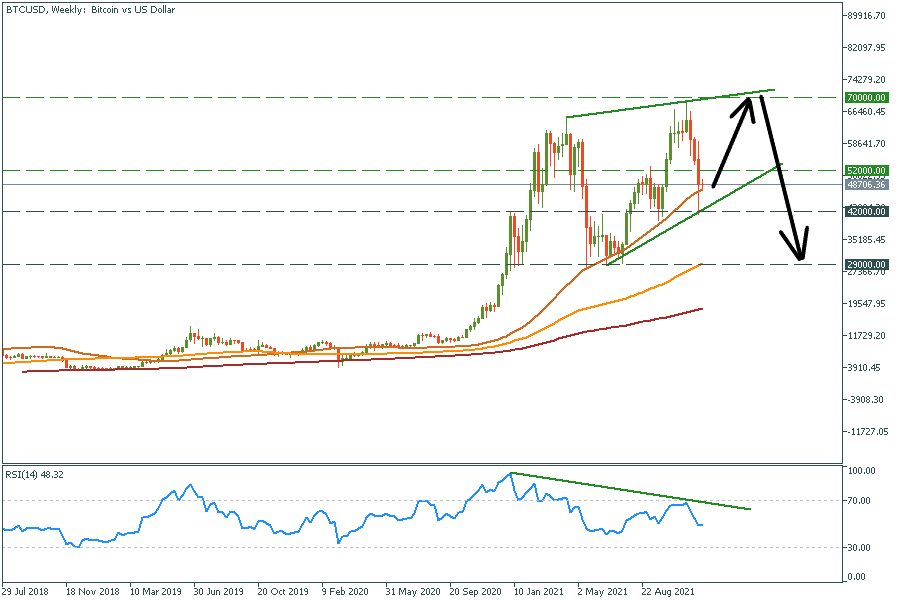

The price broke through lots of support lines. Now the chart creates a new figure on the weekly timeframe. It is a bearish wedge with 50-MA acting as support. If the $42K level stays against the bears, we may see another rally till the end of the winter, with resistance at $70k. Several bearish divergences and rising wedge will create a massive resistance area. Therefore, we would refrain from such long-term forecasts for now.

Also, keep in mind that such dumps never come alone. On smaller timeframes, we may see double bottoms with divergences. So watch out for them to catch the next big rally.

BTC/USD Weekly chart

Resistance: 52 000; 70 000

Support: 42 000; 29 000

Don't know how to trade crypto? Here are some simple steps.