Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaBank of Japan Governor Kuroda says Japan's economy will continue to recover and may reach the pre-pandemic level at the end of this year or early next year. But less than a week ago we heard a lot of opposite statements from him. What is happening with Japan’s economy and are the dark times beginning for JPY? It’s time to find out!

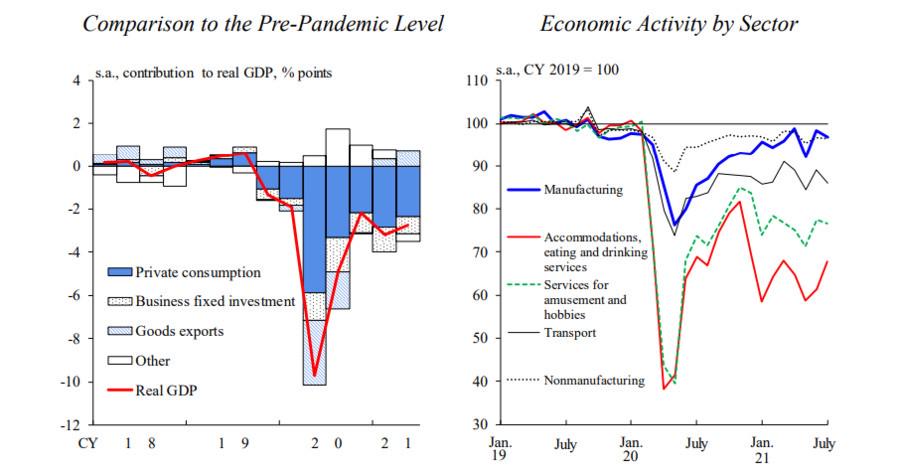

A year and a half ago, in 2020, when the first state of emergency was declared, the real GDP of Japan fell by about 10% compared with the level before the pandemic, and a wide range of economic activities were negatively affected. Since that Japanese economy tried to recover – in the next six months after the start of the pandemic real GDP has regained more than 60% of initial loss – but after that, the pace of the recovery has gradually slowed down. Even now economic activity in Japan is under pre-pandemic levels, with no signs of improvement.

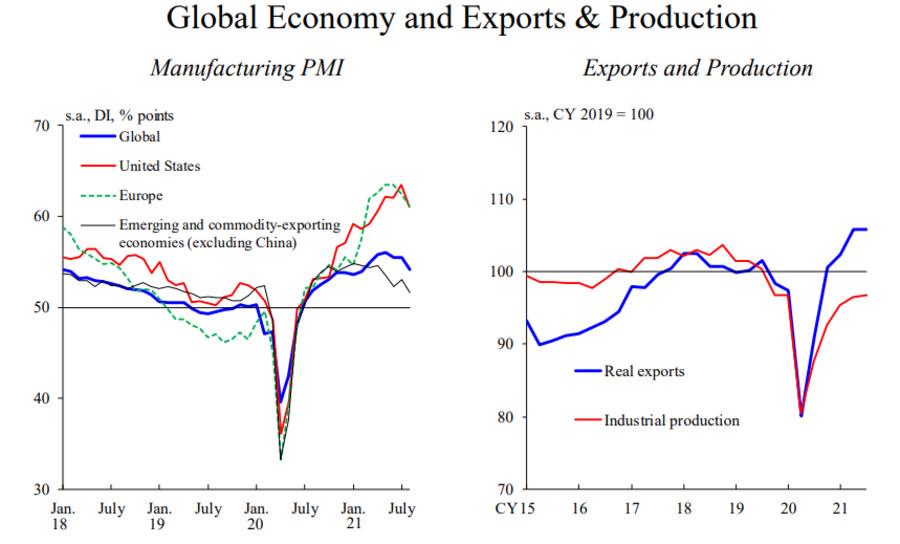

Even if we look at more positive data (PMI, exports, and production), Japan is struggling to reach the success of Europe and the United States. Asian factory shutdowns caused by the pandemic are likely temporary and could be fixed in the coming months, but capital expenditures are increasing in corporate sector.

The slow pace of the recovery is the reason for BOJ to hold the interest rate on the current level and to take more actions in response to Covid-19. For example, purchases of commercial papers and corporate bonds will be set at about 20 trillion yen ($180 billion), at maximum (the previous amount was about 5 trillion yen ($45 billion)). The BOJ extended the duration of the support program until the end of March 2022. Kuroda said that Japan's economy will continue to recover and could reach levels seen before the coronavirus pandemic by the end of this year or early in 2022.

With consumption weak and inflation well below its 2% target, however, the BOJ will maintain its massive stimulus regardless of the new government's policies. Also, to achieve and maintain target inflation, the BOJ guides short-term interest rates to -0.1% and long-term rates to around zero. That is pressing on the yen even more.

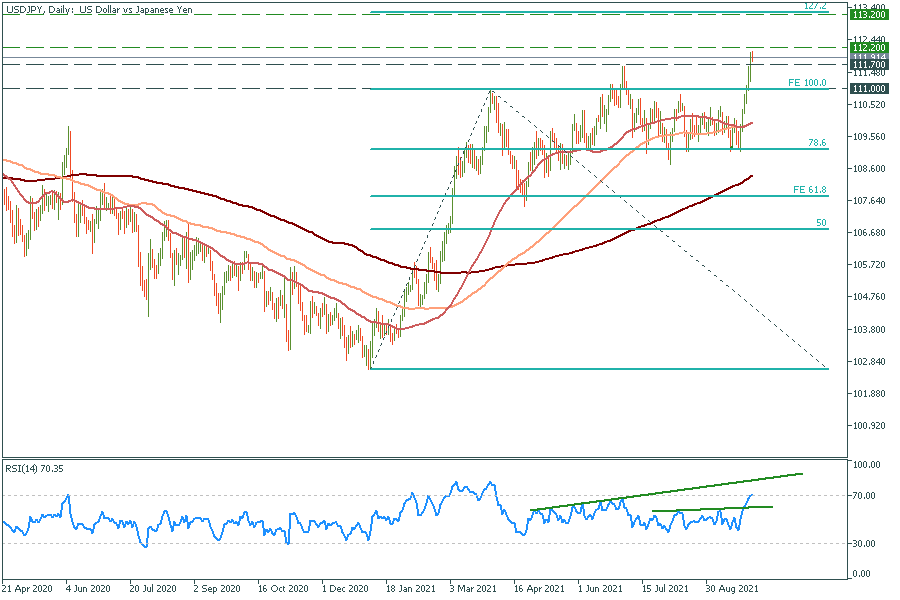

From the technical side, there is nothing to worry about: the downtrend of JPY isn’t going to stop any time soon. USD is feeling great and now is rushing through half a year consolidation. With or without some pullback, the yen will fall.

USD/JPY daily chart

Resistance: 112.2; 113.2; 116.2

Support: 111.7; 111.0