Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaApple, Microsoft, and Google reported their financial results for the second quarter. Despite strong earnings, the companies closed in red yesterday. Why? The global market sentiment worsened due to China’s tech crackdown and the Covid-19 resurgence. Besides, investors expected a tremendous profit from these companies and priced in a good outcome before the releases. Thus, investors who bought the stocks before the earnings reports started selling them afterward. In this case, traders say the so-called “buy the rumor, sell the fact” scenario happened.

The stocks from the FAANG group will keep rising in the long term with a high probability. Therefore, investors are eagerly waiting for these stocks to drop to buy them at a lower price. So, now it’s a good time for traders to enter! Perhaps you may wait longer for the prices to dip a bit lower to enter at more attractive levels. Let’s discuss the earnings results of Apple, Microsoft, and Google and also find the levels at which traders should consider buying these stocks.

Apple has released encouraging results. Just look: iPhone sales rose 49.8% in the second quarter of 2021 in comparison with the second quarter of 2020, while Apple's services revenue increased 32.9%, marking the fastest pace of growth since 2018. Wow, so good! Besides, both earnings results and revenue exceeded analysts’ expectations. These numbers tell investors that the Apple company is well-positioned and it will grow further.

From a technical point of view, Apple is just slightly below the all-time highs. It would be great if it falls to the low of July 19 at $142.00, where investors can enter the market. However, if it reverses up from the current levels, consider buying now. According to UBS, the stocks of Apple will hit $166, while JPMorgan set its price target at $175.

Google’s earnings results came out better as well. Google's core advertising business showed a 69% increase in revenue in comparison to the year prior. Moreover, Google’s cloud services and AI sector added tailwinds to the company. On the daily chart, the stock price has reversed down to the $2700 support level. It may reverse up from it today or it may drop to the low of July 19 at $2585, where a great opportunity to enter the market will appear.

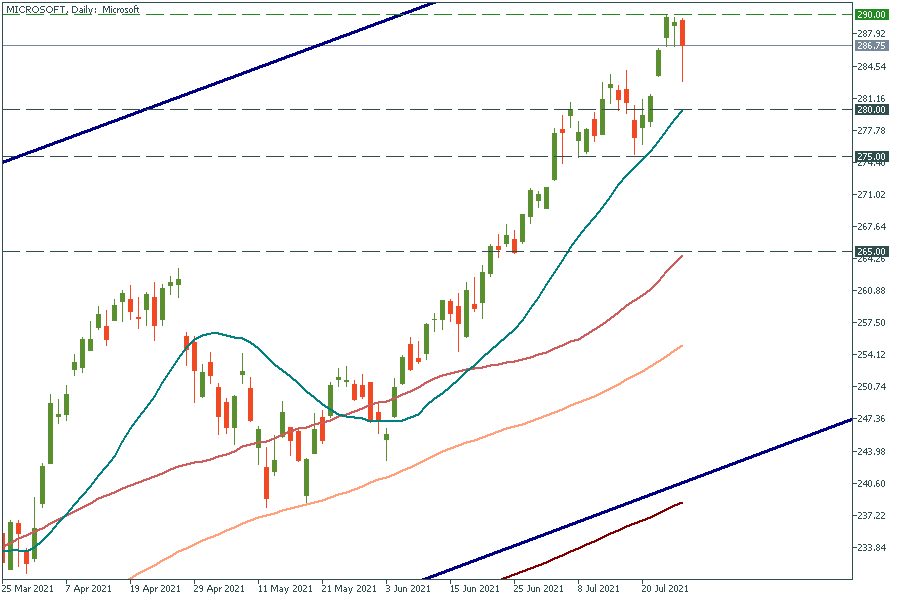

Microsoft demonstrated astonishing earnings and revenue results for the second quarter as well. Its cloud segment rose more than analysts expected. The stock price of Microsoft may fall to the 200-day moving average of $280 or even deeper to the low of July 19 at $275. These levels will be good for entering.

Don't know how to trade stocks? Here are some simple steps.