Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis century-old pharma company gained global attention on vaccine production last autumn. At the peak of investor interest, it reached as high as $43 per share – heights unseen since the middle of 2019. Although the stock price was quick to cede the gains later on, it’s still in an uptrend. A positive Q1’2021 report may well push it to those heights again - fundamentally, there are all the reasons to expect strong performance.

Technically, if the report is better than the forecasts, the stock will likely rise to $41 and take $43 as a mid-term upside objective.

Remember you can trade stocks in Metatrader 5 or FBS Trader app!

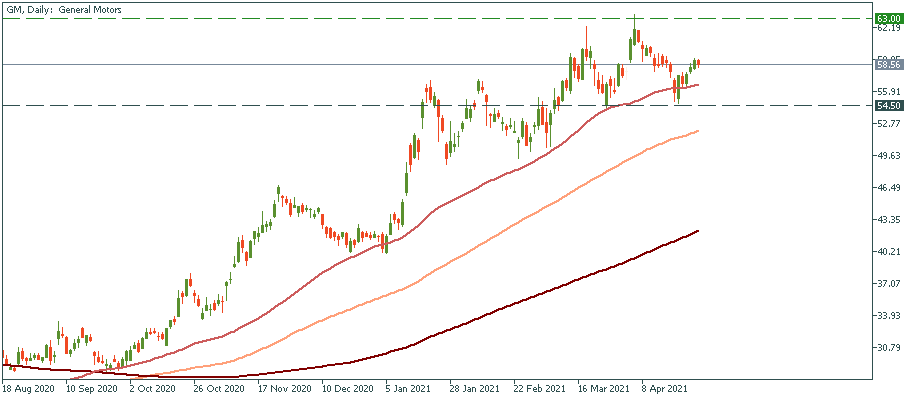

This pillar of the US vehicle production industry not only managed to recover from the virus hit but reached strategically new highs of $60 – as high as never, at least over the course of the last ten years. The stock is now in a local drop so a strong report will push it back upwards to establish itself at new heights.

During the previous two quarters, GM managed to beat the expectations of observers brings better-than-thought results. In absolute figures, performance of Q1'2021 is expected to be lower than that of the second part of 2020. Hence, there is a big potential for GM to surprise the market and send the stock soar.

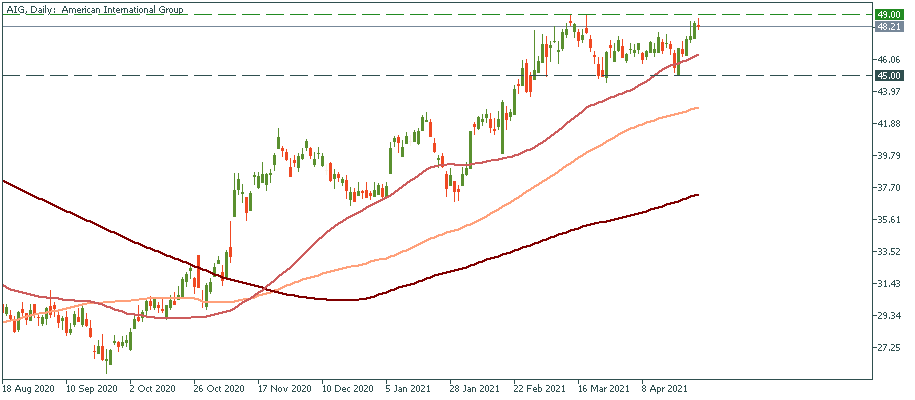

This financial and insurance corporation has not been doing well – it’s one of the companies that haven’t recovered the virus losses. Meeting March 2020 at the ranges of $50, this stock dropped as low as $20. Currently, it’s on the way upwards – right at the gates of the pre-virus level. Forecast-beating data will help it make a 100% recovery and move further upwards.

Last time, AIG's results were lower than the forecasts - that's one of the reason why observers are quite modest with their expectations this time. In the meantime, if AIG manages to outperform, that may be a real boost to its stock - tactically, it may aim at the pre-virus high of $56. That's only in case the data is exceptionally strong, though, which is not that likely. So, let's see the report out and watch the market reaction.