Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

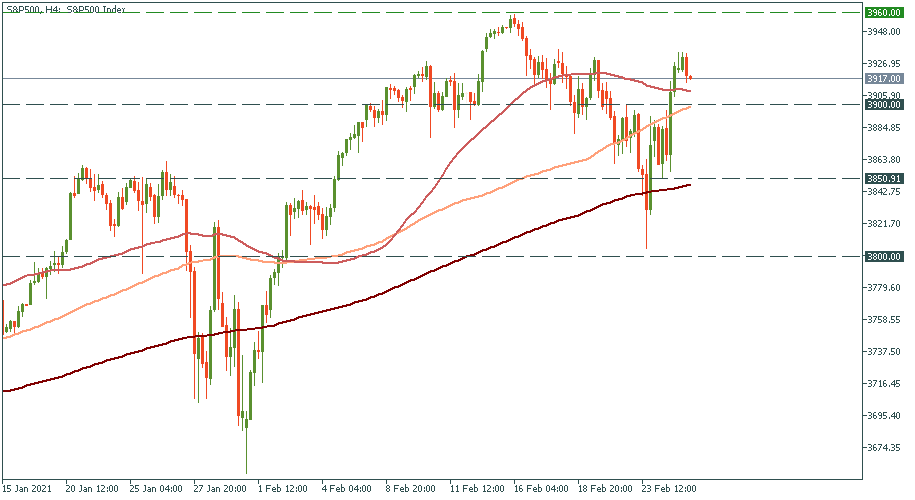

Personal areaFinally, the stock market is seeing better days. After having peaked at 3 960 two weeks ago, the S&P went into a fortnight plunge. It dropped as low as almost 3 800 at the beginning of this week. However, since then, it recovered most of the losses crossing all the MAs above 3 900.

What we have to do now is to watch the support of 3 900 and the MAs around it. It’s advisable to hold and abstain from entering the market so far. If the index crosses this formidable support downwards, that would mean that the bearish potential is not exhausted, and we are yet to see more downtrend.

Otherwise, the S&P will bounce from the support upwards – in this scenario, it will likely cross 3 960 to finally challenge 4 000, forming a new uptrend.