Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

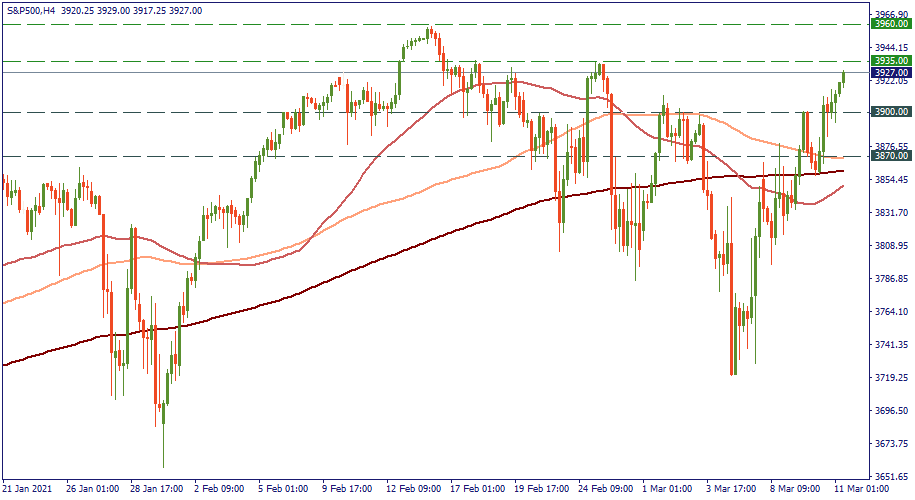

Personal areaThe stock market seems to be on a bullish track now. The S&P bounced upwards from the support of 3870 where the three Moving Averages were converging and currently is flirting with the four-week resistance of 3935. What to do now?

Watch how the index behaves against the resistance of 3935