Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

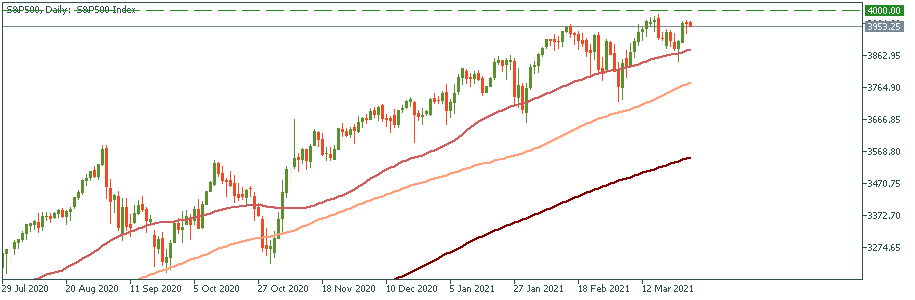

Personal areaThe stock market keeps steadily going upwards towards the mark of 4000. While there have been and will be inevitable dropdowns below the support of the 50-MA, the overall trend is a clear uptrend. What's important is that the recent turbulence was not as high as the one in September-October - that's a sure sign of true recovery and stabilization of the economy seen in the corporate environment. Having that as a background, let's review particular stocks now.

No one can deny Elon Musk the liberty to say whatever he finds necessary on Twitter. That doesn't mean it does any good to the valuation of Tesla, though. Sometimes we may even think that he does it intentionally like that time when he said that Tesla's value is too high - and the stock dropped.

The announcement that Tesla may be bought with Bitcoins didn't prevent the stock price from going down. Partially, because of another controversial tweet about unions that the US authorities are considering as a possible threat to labor union participants. On the other side, there was another comment that Elon Musk tweeted - and eventually deleted is that very soon, Tesla may weigh more than Apple. Whatever there is, the support of 550 is there, and it may be reached again. At the same time, a bounce upwards is also possible. For this reason, if you're considering taking a rather risky mid-term position, you may think of buying Tesla - that's if you're ready to hold out enough time until it starts recovering. Because when it does, then from the current $600 to the all-time high of $900 it's a 50% value growth potential.

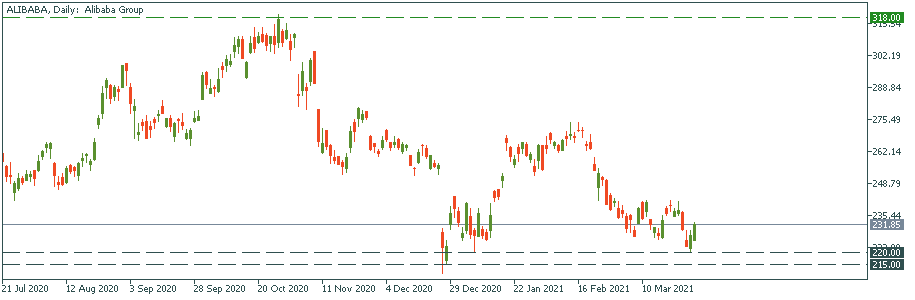

Alibaba is now under double pressure. First, Jack Ma's company is under direct pressure, scrutiny, and counteraction from the side of the Chinese authorities. Second, strategically, global geopolitical tension between China and the "Western world" growing around the Uyghur region is making the future of Alibaba even more cloudy than it is now. In any case, the stock is now at nine-month lows. Moreover, it trades above the support zone of 215-220. Technically, a bounce upwards is very possible. If it happens, then there is the entire $100 above to meet the all-time high again. Potentially, it's an almost 50% value gain possibility - that may take a few months, though. Therefore, Alibaba may be a risky buy for a long-term strategy. Or, observe it further as fundamentally, grounds are shaking beneath Jack Ma's feet.

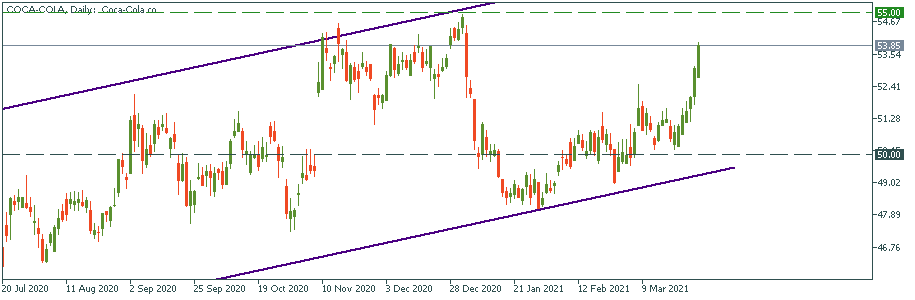

Shooting up from $50 to $54, Coca-Cola performed as well as never since the start of the recovery. Definitely, it's one of the best performers of the S&P 500 so far. Fundamentally, it has a very good business outlook. Sales are going better and better, most observers suggest it's a buy stock - for a long-term scenario. For the short-term, though, you have to take into account that this growth was really aggressive. Not that it never happens in the stock market but this stock has been oscillating between the two sides of the indicated channel since March. Currently, it's in an upswing. However, observe it closely as it approaches $55. At or slighly above that mark, it may reverse to do a technical correction - in this case, it may go all the way down to $51-52. Therefore, observe possible reversal pattern in the shotrt-term - they may occur at any time.