Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe first day of summer is here! What was May like for the US stock indices? And, most importantly, what should we expect next?

Last month, the market was swinging between the risk-on and the risk-off. On the one hand, a concern around surging inflation was the main factor driving the American indices down last month. For example, the US Core PCE Index, one of the Fed’s favorite measures of inflation, increased by 0.7% in April to the highest level since 1992. Investors worry that massive injections of liquidity will keep the inflation pressures high for a prolonged time. Despite this uncertainty, the Fed members still see the rise of this indicator as temporary. Fed’s opinion seems controversial to some investors. As a result, the indices remained pressed in May.

On the other hand, indices could not avoid a fast vaccination pace in the United States combined with the economic reopening. As the monetary policy in the US remains loose, the massive capital inflows push the American stock gauges to new highs.

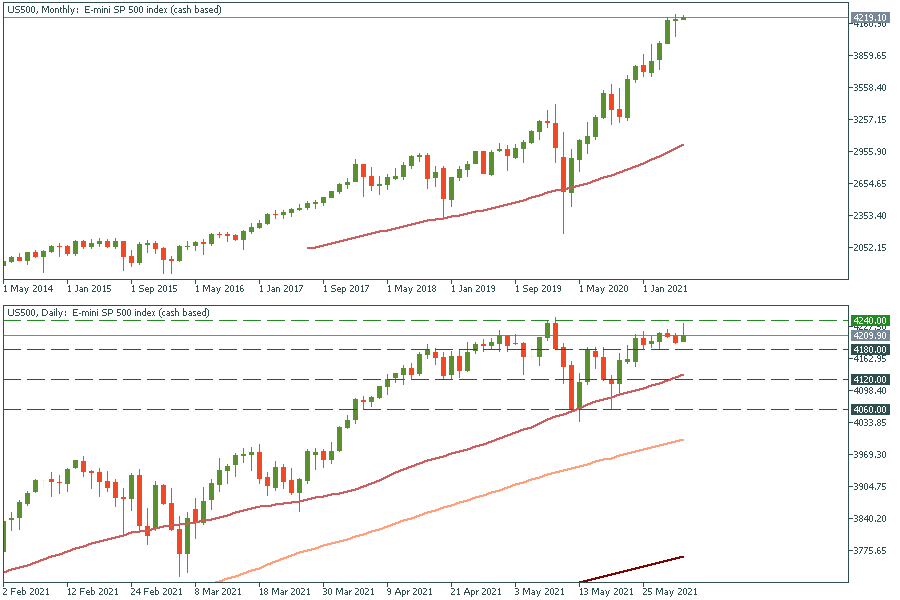

If we look at the monthly chart of S&P500, we can see that May’s candlestick is a Doji one. This is a warning sign for traders. However, given to existing fundamentals, the retest of 4240 and the breakout to the next high of 4300 are possible.

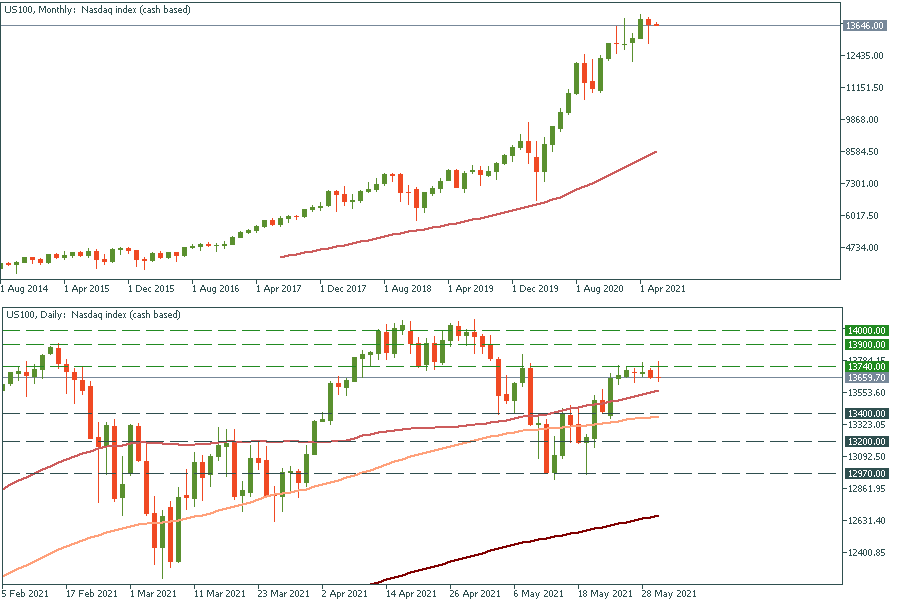

As for NASDAQ, the overall picture on the monthly chart was not so bright, as the index dropped below 13,000. By the end of the month, it has managed to recover and reached the resistance of 13,740. The next obstacle for bulls will lie at 13,900.

This month, we need to stay extremely focused on the US inflation and speeches by the Fed members. If nothing changes, we may see new highs of the indices above and the pullback afterwards.