Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

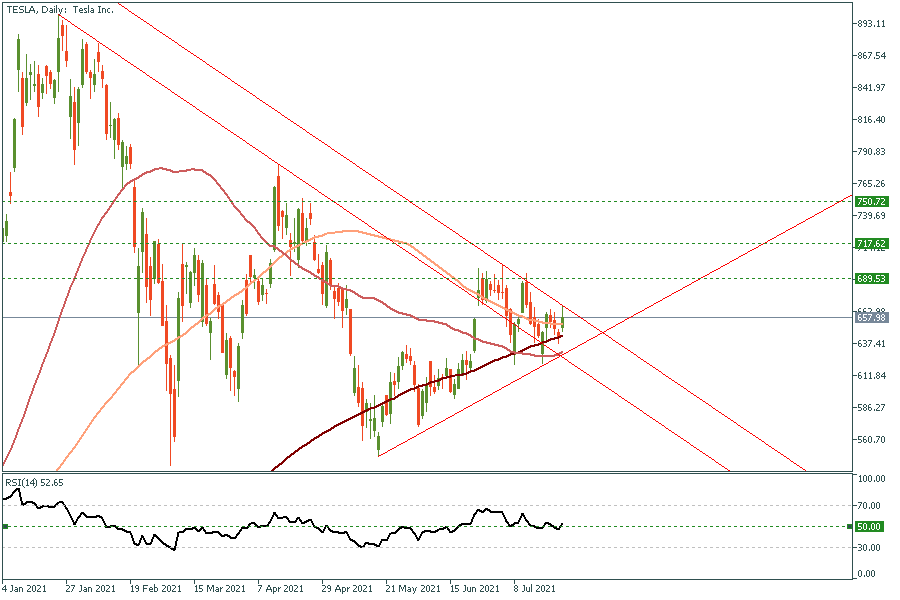

Personal areaTesla surprised the markets again with record earnings. The positive report keeps the momentum for a better-than-expected earnings season in the US. Tesla's Q2 EPS came in at $1.45 vs. 97C estimated. Revenues also showed another surprise with $11.96B vs. $11.36B estimated. The biggest surprise came in from the Free Cash Flow which posted $619M vs. a deficit of $319M. The company still sees 50% average annual growth in deliveries, while the biggest challenge ahead remains in the supply of microchips.

Overall, Tesla’s earnings represent a new positive factor despite all the challenges of the Covid19 era and it looks like the company has entered a new phase or possible sustainable profits in the coming years.

TSLA soared to $695 after hours and trimmed it back to $664. The conference call also was balanced with no hiccups from Elon Musk. With that being said, dips are for buyers this week, and expecting the stock to retest $750 in the coming weeks could be reasonable.