Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaAfter volatile months, the Australian dollar seems to step back from its top-performing positions. Now, traders of the aussie await the next driver that may bring the fresh wave of high and lows to the Antipodean currency. Will the meeting of the Reserve bank of Australia (RBA) on Tuesday at 04:30 MT time be that long-awaited trigger for the AUD?

According to the forecasts, the Reserve Bank of Australia will keep its monetary policy as it is now with the lowest interest rate of 0.1% and the massive bond-buying program extended in February. Back then, the RBA introduced additional $100 billion purchases at a rate of around $5 billion a week after the completion of the first package. The RBA Governor Philip Lowe reiterated that the interest rate would remain unchanged until 2024. The main factors that determined the bank's actions were unemployment and inflation levels.

Surprisingly to the markets, the employment level showed an impressive recovery in March. The Australian labor market posted 88.7K jobs, beating the forecast of 30.5K. The unemployment rate fell to 5.8% - the lowest level in almost a year. The RBA may provide its opinion on the boom in the labor market, but we don’t expect a major shift in its views, as the global economy is far from a full recovery and risks still exist.

Another factor the RBA keeps an eye on is a skyrocketing housing market. The property surged amid record-high interest rates and the federal government's HomeBuilder grants program.

NAB recommends following banks' steps on preventing the risks of the housing boom.

With no changes expected at the upcoming meeting, we recommend you focus on the overall tone of the statement. This may help you with short-term trading decisions.

If the RBA's tone is optimistic, the AUD will inch to the upside. These factors include optimism around employment, brighter outlook, and shift in the rate expectations.

Alternatively, gloomy expectations and cautious comments on recovery will be seen as negative factors for the AUD.

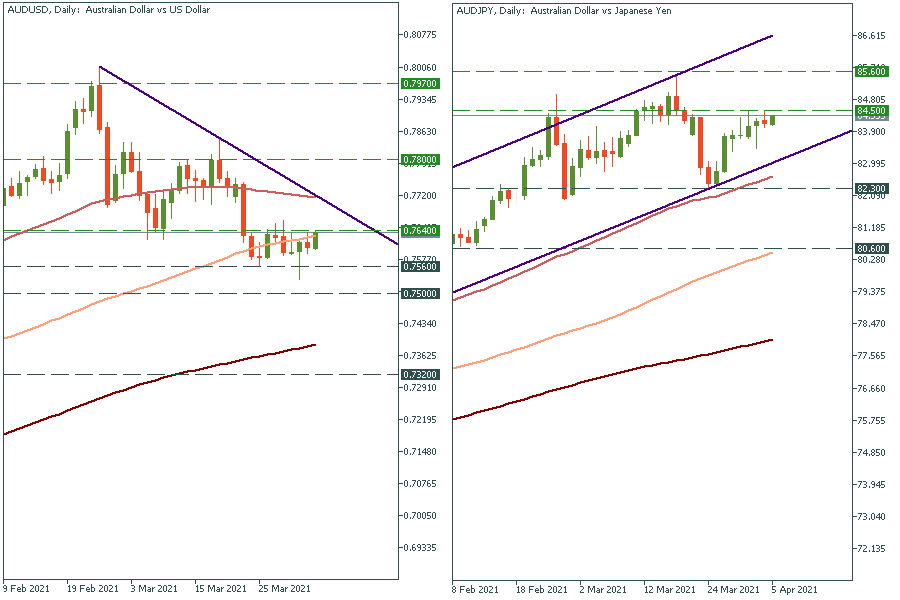

For longer-term trading decisions, you need to follow the technical outlook. Technically, traders need to prepare for the shorts of AUD/USD and AUD/JPY.

AUD/USD formed the pattern that resembles "Head and Shoulders" with the neckline at 0.76. The breakout of this level will lead to a further fall to 0.75. On the upside, the resistance lies at the upper border of the range at 0.7640. If bulls break it, the next key resistance will lie at 0.78.

As for AUD/JPY, for now, it is moving within the ascending channel. The pair reached the levels of 2018 and corrected. Now it is trading below the resistance at 84.50. If the strength of the AUD is limited, the support at 82.3 will be broken. This way, we will see the breakout of the channel's border.