Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaTwitter, the US IT company, will present its earnings report for the second quarter on July 22 after the stock market closes (23:00 GMT+3). The release will be followed by an investor conference call at 1:00 MT, July 23.

Investors do not expect too much from the company’s report on Thursday. User expansion is slowing after the pandemic-driven bump, while the economic environment is becoming uncertain for growth stocks amid surging Delta variant cases.

In the first-quarter report, Twitter warned investors about a slowdown for the second period. For the rest of the 2021 year, the company predicts “low double digits” user growth, with the lowest numbers in the 2nd quarter.

Unlike main competitors, Twitter does not earn money from direct response advertising. Direct response advertising is the main feature small business uses to attract new customers, which is the reason it bumped after the lockdown was over. In the business model, Twitter relies on big brand advertising, which makes 85% of this total sale.

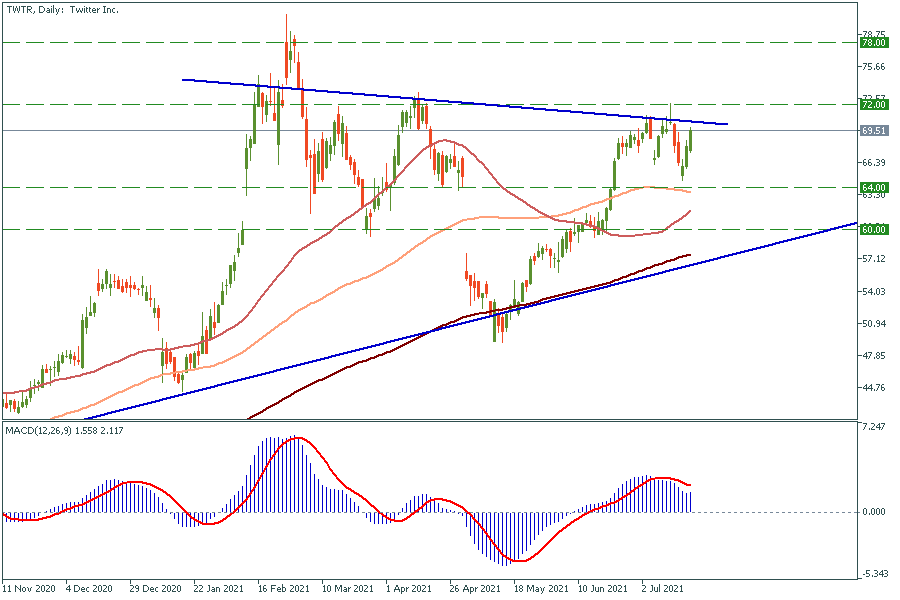

Daily chart

As the report will be posted during the post-market session, the price movements might be highly volatile. The short float is 2.61%, which means a huge growth should not be expected. It looks like after the weak report the price will drop down to the 50-period moving average at $67. If the price breaks this support, it will go down to $64.

Don't know how to trade stocks? Here are some simple steps.