Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis week is full of important news, starting with PMIs in the key economies, with Jackson Hole Symposium as a cherry on the top. Weak Flash US Manufacturing and Services PMIs (61.2 actual vs. 62.4 expected and 55.2 actual vs. 59.1 expected respectfully) are questioning the strength of the USD. Will Jackson Hole add to the pressure or will it send the dollar up?

Jackson Hole Symposium is important due to central bankers often signaling important shifts in monetary policy. For instance, in 2008 Fed Chairman Bernanke tabled repeatedly to strategize with other high-level policymakers about the response to the Global Financial Crisis, in 2014 ECB President Draghi laid the groundwork for QE, and in 2020 Fed Chairman Powell announced average inflation targeting framework (it is the Fed’s long-run monetary framework that has replaced inflation targeting).

With the top policymakers from the ECB and Bank of England skipping this year’s event, traders’ focus will be almost exclusively on the US Federal Reserve, specifically any hints about the central bank’s timeline for tapering its asset purchases. Last week’s FOMC minutes showed a divided committee, and that came after a mix of optimistic (strong NFP jobs report) and pessimistic (poor consumer sentiment, a doubling of US COVID cases) news over the last month.

However, so far market’s expectations about tapering haven’t been met and dollar is under growing pressure. Last week dollar index hit a nine-month high on bets that the Fed would start shifting away from its accommodative monetary policy, but that view began to change on Friday when Dallas Fed President Robert Kaplan said he might reconsider his hawkish stance if the virus harms the economy.

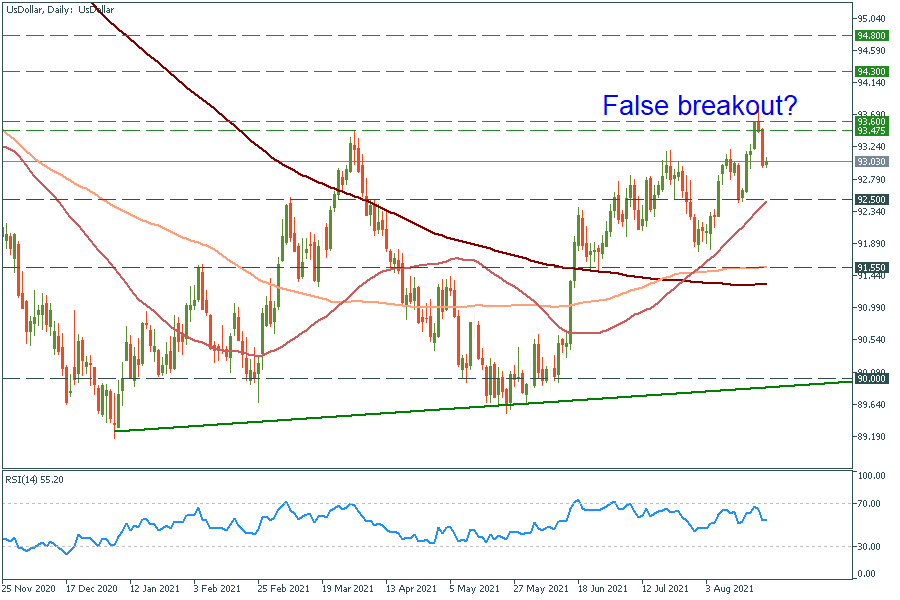

UsDollar Daily chart.

Support: 90.0, 91.5, 92.5.

Resistance: 93.475-93.6, 94.3, 94.8.

Last week, when traders thought that the Fed would hurry to start tapering asset purchases, the USD rose and S&P 500 corrected down. On the contrary, when fears of tapering somewhat subsided, the US currency weakened and stocks set new highs – this is how this week has started. If concerns about covid-19 make the Fed postpone tapering up until next year, stock markets will get even higher.

US500 Daily chart.

Support: 4270, 4370.

Resistance: 4600

Elsewhere, oil has gained momentum on the news about zero new COVID cases in China. Another possible bullish factor is an explosion of Ku-Alfa, the oil production platform of Pemex company. This is one of the richest Mexican oil deposits with a production rate of close to 640K barrels a day. If the company can't cope with the situation, the prices will tend to rise, pressuring the greenback even more.

Although the oil has generally been able to shrug off strength in the stock market, the bullish combo of increased risk appetite and significant weakening in the U.S. dollar indices represents a potent mix that oil has been forced to recognize.

XBRUSD H4 chart.

Support: 65.0

Resistance: 69.7, 71.5, 72.5.