Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis week may fairly be called a week of monetary policy reports. On Wednesday, Thursday, and Friday, we will have the US Fed, Bank of England, and Bank of Japan provide their interest rates and monetary policy reports respectively. Therefore, it makes sense to expect possible movements in the USD pairs as well as those with the GBP and JPY on the corresponding days.

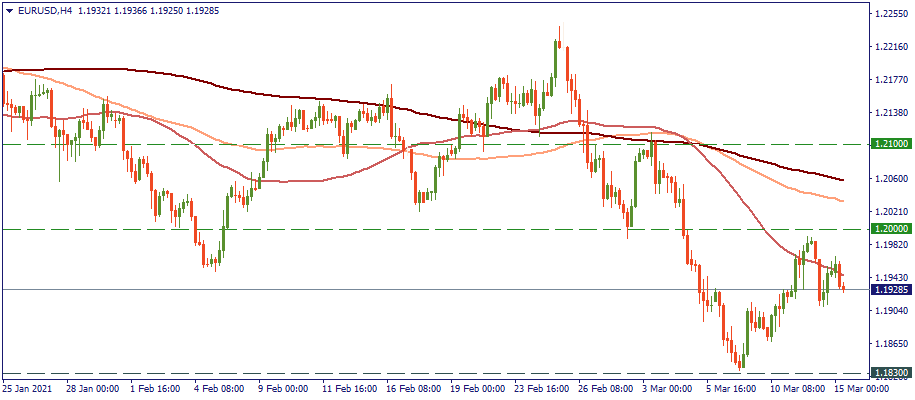

After bouncing downwards from below the tactical resistance of 1.20, this pair trades under 50-MA. While the mid-term outlook speaks in favor of the USD, local bearish action is a very likely scenario – especially if the US Fed comes with an upbeat domestic economic outlook. The support of 1.1830 may be the target to watch in this case.

Gold bounced off the resistance of 1740. Although it trades above the 50-MA, the lower highs formed in the last two weeks in combination with the failure to break the mentioned resistance suggest that bears may drag it down. 1680 is the local support to look at.

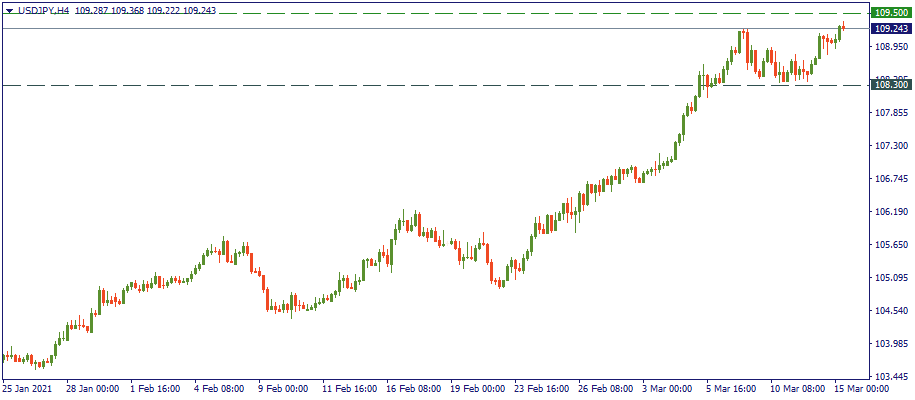

This pair trades at 8-month highs. The resistance of 109.50 left by the June performance is one step away and may be passed if the US Fed’s report supports the USD. On the other hand, hawkish tones from the BOJ may reverse the movement and send USD/JPY back downwards.

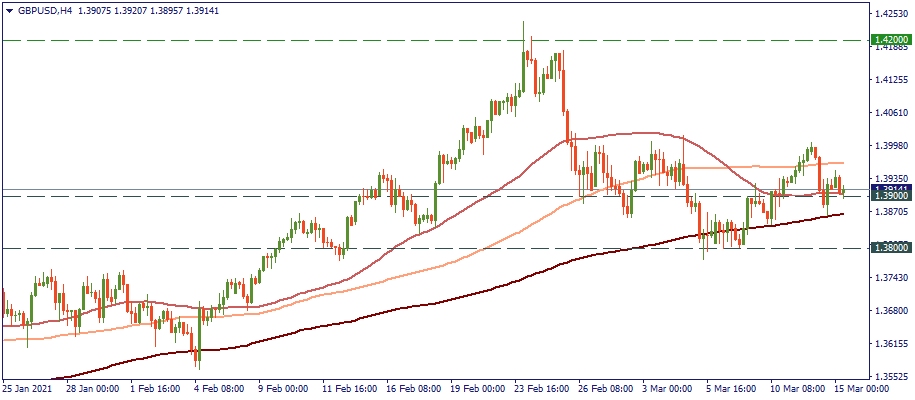

After reaching 1.42, GBP/USD fell to 1.39 where it trades currently. However, that’s still within the larger uptrend. Therefore, bulls may get back to lift the pair to the local highs of 1.40.