Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaVirgin Galactic's stock price dropped by 50% after its first fully crewed flight carrying its founder, Richard Branson.

There are a couple of factors driving the decline including the company’s move to sell about $500 million in the stock a day after the test flight, and rival Blue Origin’s successful crewed rocket ship launch in mid-July. Moreover, investors are likely looking beyond Virgin’s test flights to its commercial flying timeline, which is likely at least one year away. We think that the recent drop might be a good buy opportunity for several reasons.

The successful flight proved the beginning of a new space era. The community has become more confident that Virgin Galactic is not a start-up anymore. Moreover, the company raised the flight price from $250.000 to $450.000 which proves their confidence in future demand.

The space flight sector is still in its early stages. Also, the main competitors Blue Origin and Space X develop deep space flights and leave Virgin Galactic the only company in the space tourism sector.

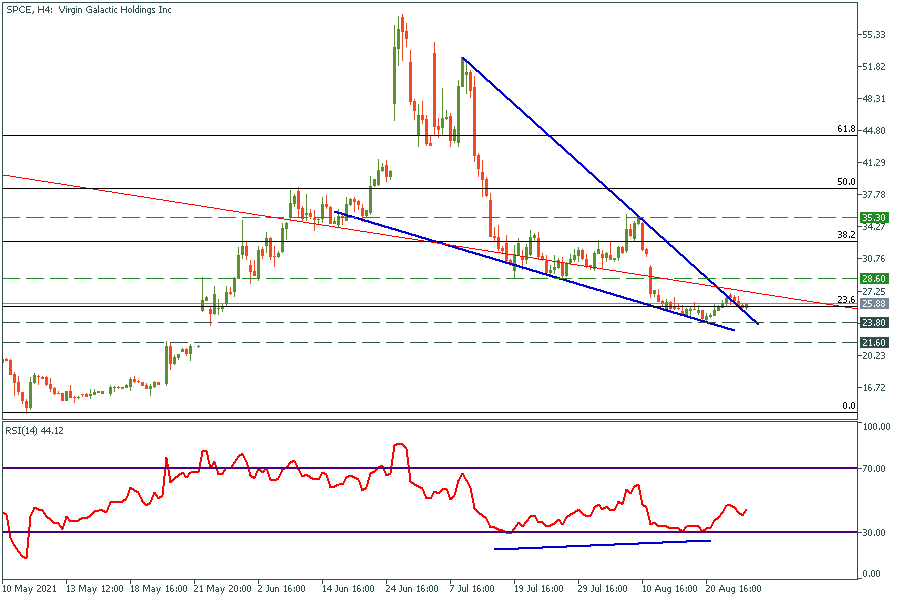

4H chart

Virgin Galactic stock price has formed a bullish “falling wedge” pattern with a small RSI divergence. According to this situation, the main target is $28.6. If the price breaks this level we might see Virgin Galactic worth $33 shortly.

On the other hand, if the price doesn’t hold the $23.8 support level, the way to $21.6 will be open.