Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWalmart, America’s biggest retailer, will present its earnings report for the second quarter on Tuesday, August 17 before the stock market opens (14:00 GMT+3). The release will be followed by an investor conference call at 15:00 MT, August 17.

Walmart benefited from the pandemic as people increased grocery items and daily staples consumption. The retailer has warned investors that 2021 will not be as successful as 2020 was. Walmart’s analysts expect a slowdown in sales and revenue as consumers will take a break from their pantry loading habits.

Nevertheless, Walmart has already outperformed the Q1 expectations. It demonstrated $138.3 billion of revenue and $1.69 earnings per share (analysts predicted $132.2 billion and $1.21 respectively). Investors appreciated these results and pushed the stock up by 3%.

Analysts and experts’ expectations for the Q2: Revenue = $136.6 billion, EPS = $1.56.

The Q2 expectations look optimistic as Walmart demonstrated a 10% revenue decrease in Q1 2021 comparing to Q4 2020.

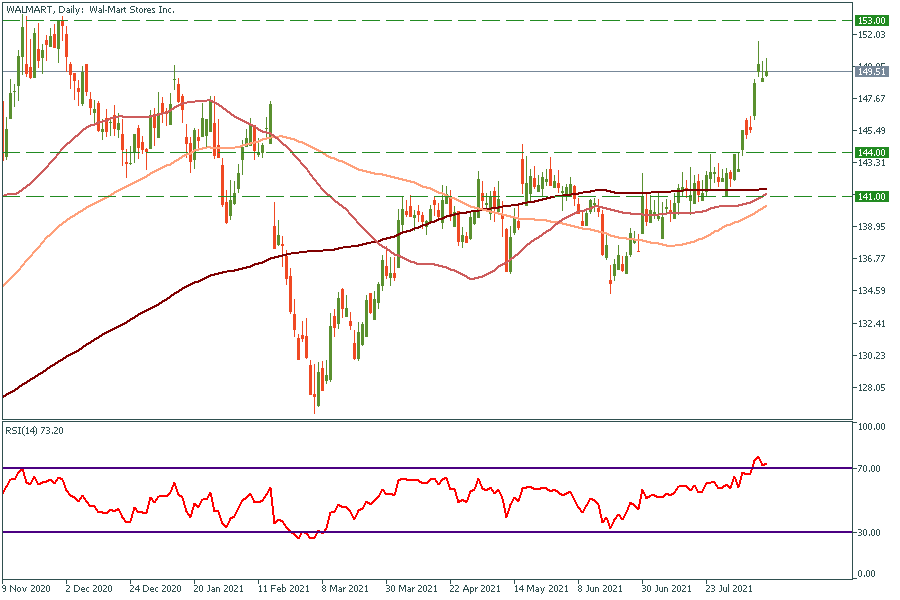

Daily chart

It is seen that during the past three trading days investors were selling the stock at $150. The RSI also shows the stock is locally overbought. It looks like investors were buying Walmart stock ahead of the earnings report and as practice shows, it usually leads to a drop after. As the famous rule says: “Buy rumors, sell facts”. The closest support levels are $144, $141.

If the financial results are extremely good, the stock might be pushed higher, but as it is said there is no a lot of space above (according to the RSI). The closest resistance is $153.