Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe Central Bank of Russia makes an interest rate decision today at 13:30 MT time. Analysts expect the regulator to raise its interest rate from 5% to 5.5%. After the announcement, the Central Bank of Russia holds an online press conference with its Governor Elvira Nabiullina.

There are a lot of events that are driving the Russian currency these days. First of all, US President Joe Biden and Russian President Vladimir Putin have finally set their meeting date for June 16. The sides plan to find common grounds after the new round of sanctions. For instance, one of the US bans blocked US banks from buying OFZ government bonds directly from Russia since mid-June.

Another factor that is pushing the RUB higher is rising inflation figures. In May, consumer prices jumped 6%, faster than the market expectations of +5.8%. That's why the bank's intervention is required to hold inflation within its target level.

Finally, the Russian ruble is a commodity currency, so the optimism in the oil market is supporting it. Given all the factors mentioned above, the bank may boost its rate and make the RUB more attractive for carry-trade operations (when investors convert lower-yield currencies into rubles to buy bonds with high-yields).

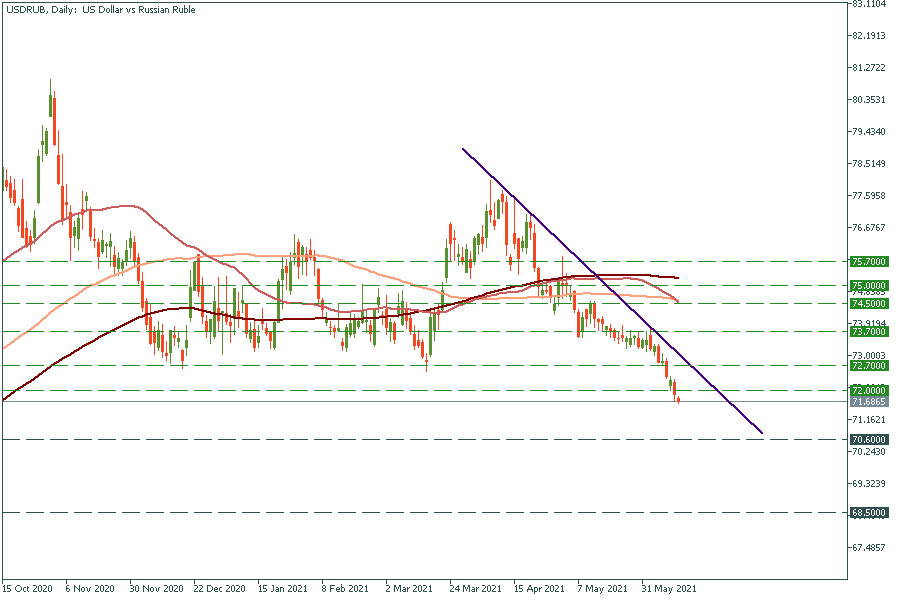

The pair has fallen to the lowest level since July 2020. A strong support level is placed quite far from the current price (at 70.60), so we may expect a further slide after the rate hike is confirmed. On the upside, the resistance levels are placed at 72 and 72.70.