Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaAccording to the recent report by the Australian Department of Industry, the country is forecast to earn around 136 billion Australian dollars from the ore exports this year. If it happens, it will mark a new record for the ore-producing continent.

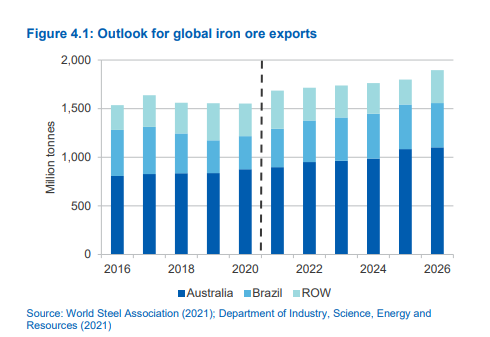

It’s not a secret that Australia is the largest iron ore producer in the world. Driven by the stabilization of the demand from the largest iron ore producers – China and India, the production levels have increased. Post-shutdown euphoria adds fuel to the prices of iron ore as well. Now, the government expects the export volumes to grow to 1.1 billion tonnes by 2025-2026 due to new mines opening in Western Australia.

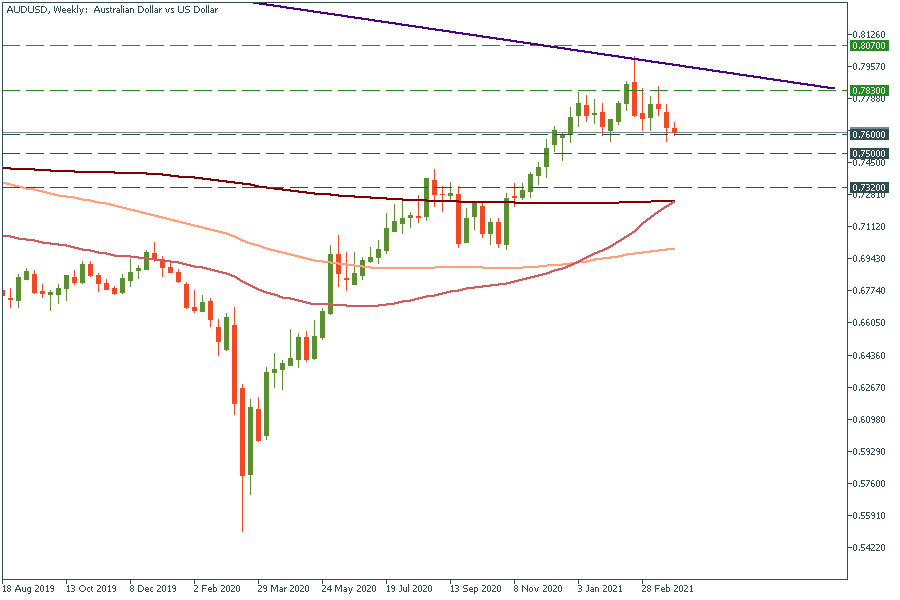

The optimistic forecasts improve the long-term outlook for Australia, as they signal a rapid recovery from the pandemic. This factor may add bullish momentum to the Australian dollar, which is currently trading above the weekly support of 0.76. The strength of the USD pulled AUD/USD lower from the long-term trend line. However, the situation can change. If bulls try to take over the market once again, they will push the currency pair to 0.7830.