Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaUSD/JPY has finally escaped the channel, breaking through its upper line. If it manages to break through the resistance zone of 109.00-109.15, it will rally up further to the early April highs of 109.90-110.00. However, since the RSI indicator is close to 70.00, the price is too high and the reverse down may happen soon. If it crosses yesterday’s low of 108.65, it will fall to the 50-period moving average of 108.25.

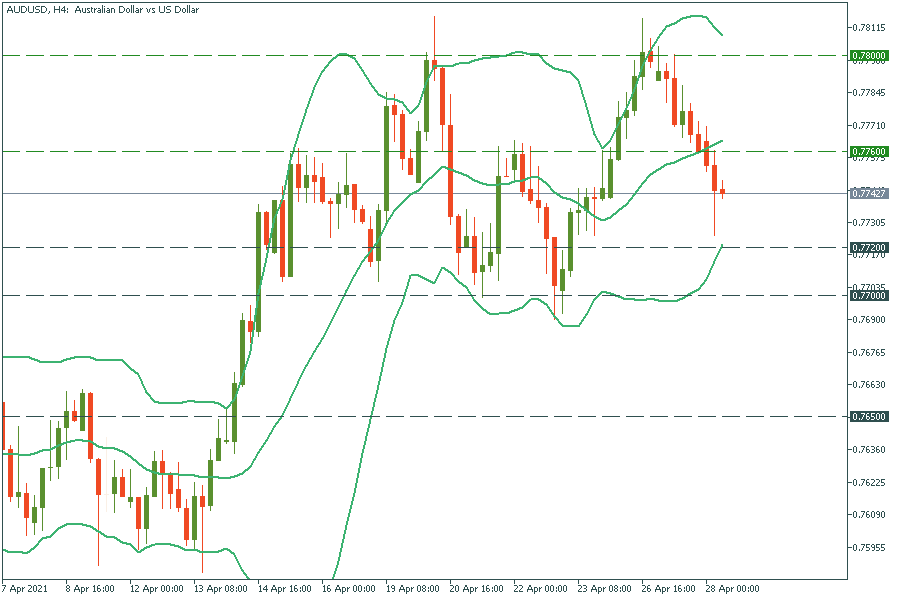

AUD/USD is falling on the poor inflation data. It’s getting closer to the lower line of Bollinger Bands of 0.7720. If it manages to break it, the way down to the chain of recent lows of 0.7700 will be open. The price shouldn’t break lower 0.7700 on the first try. The move above the midline of BB at 0.7760 will push the pair up to Monday’s high of 0.7800.

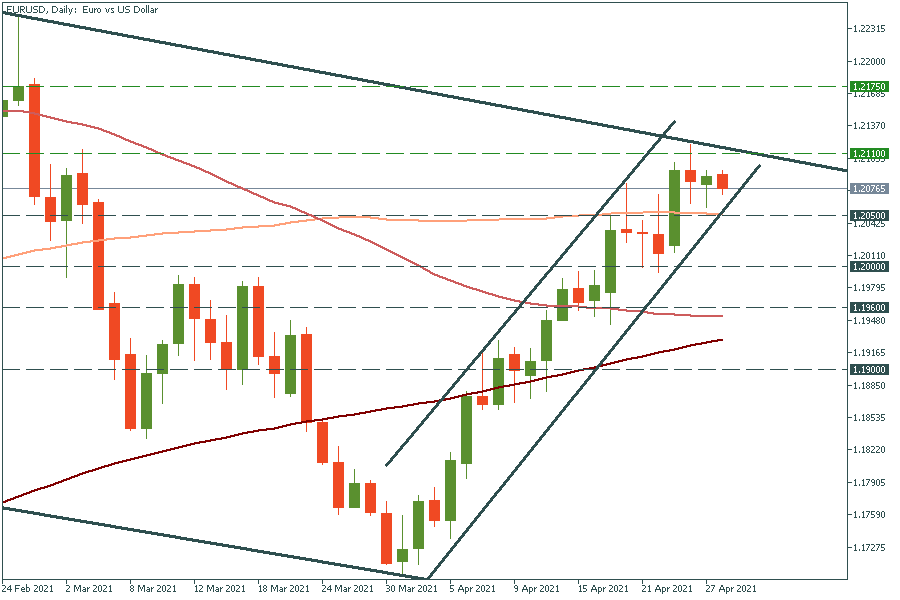

EUR/USD is edging higher inside the channel in the short term, but the long-term trend is still downward. Thus, if it breaks through 1.2110, it will push the pair further up to the two-months high of 1.2175. Support levels are the 100-day moving average of 1.2050 and the one-week low of 1.2000.