Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe reflation is the expectation of a return to global economic growth after the crisis (the Covid-19 pandemic). Central banks offer huge financial support (decrease rates and increase bond buys) and inflation is getting too high. These conditions are good for cyclical stocks such as banks, energy producers, cruise companies, airlines, etc. Since the Fed said it would start cutting bond buys soon – reduce the financial help, the reflation trade has waned, and all these cyclical stocks dropped, while big tech stocks rocketed.

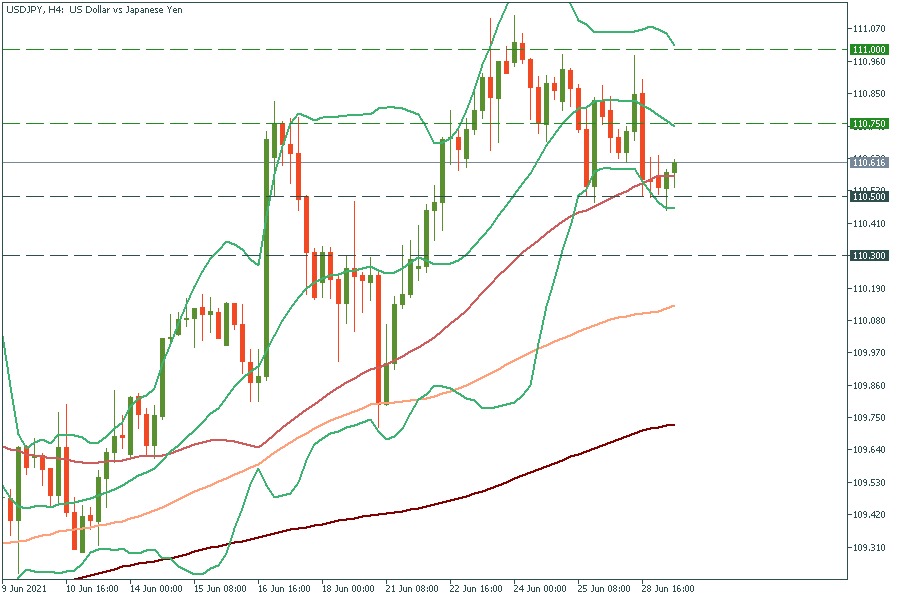

USD/JPY has reversed to the upside due to the strong US dollar. It has even crossed the 50-period moving average, confirming the bullish momentum. It’s likely to rise to the mid-line of Bollinger Bands at 110.75. The move above it will drive the pair to the psychological mark of 111.00.

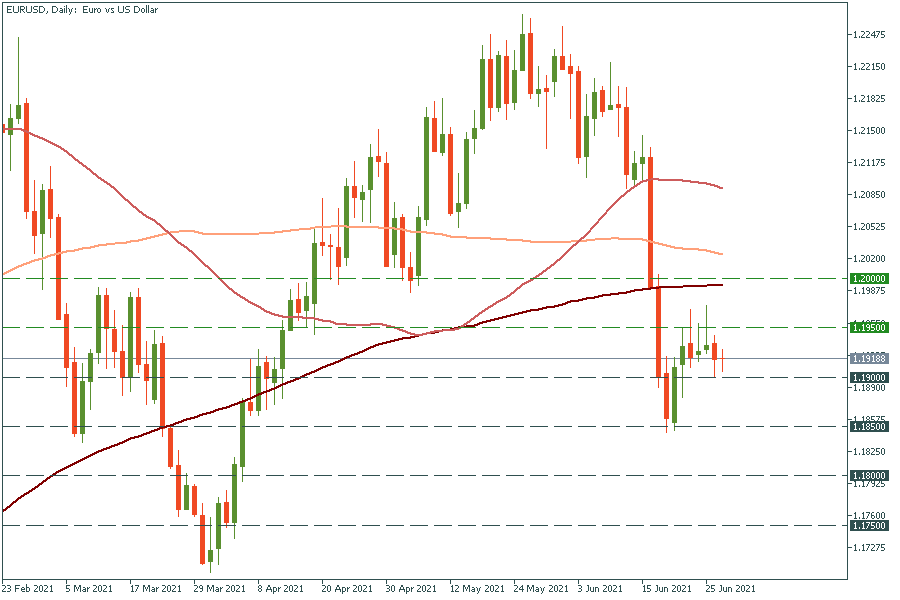

EUR/USD has reversed down and it looks like the correction is over and the pair will fall further. The breakout below the 1.1900 support will press the pair down to the low of June 21 at 1.1850. Just in case, if the pair crosses above the recent highs of 1.1950, it may rally up to the 200-day moving average of 1.2000.