Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

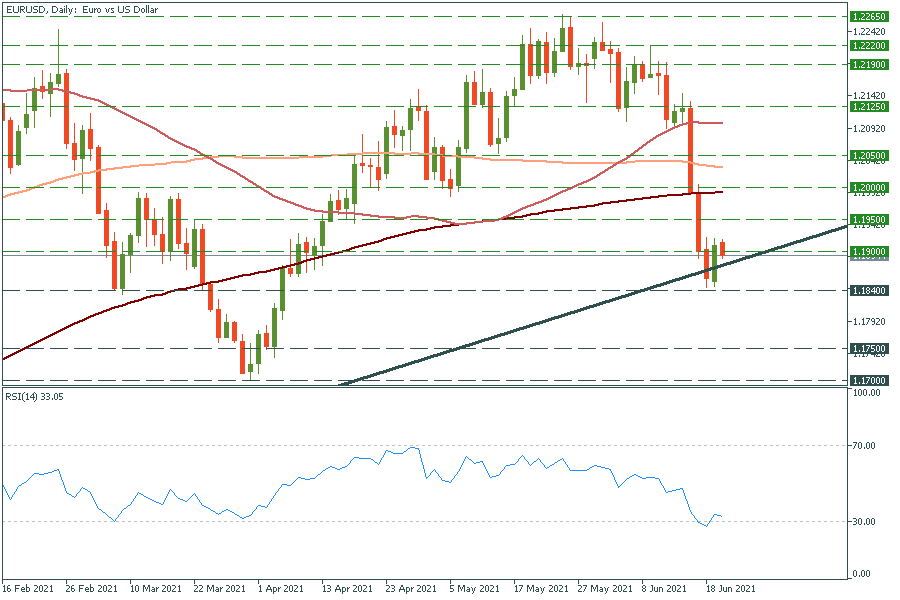

Personal areaLet’s start with the most traded pair in the Forex market: EUR/USD. The RSI indicator has bounced off the 30.0 level, giving a bullish signal. The pair has managed to come back to the area inside the channel. It has briefly jumped above the psychological mark of 1.1900. If it jumps above 1.1950, it will rally up to the next round number of 1.2000. In the opposite scenario, the move below yesterday’s low of 1.1840 will press the pair down to the 1.1750 support.

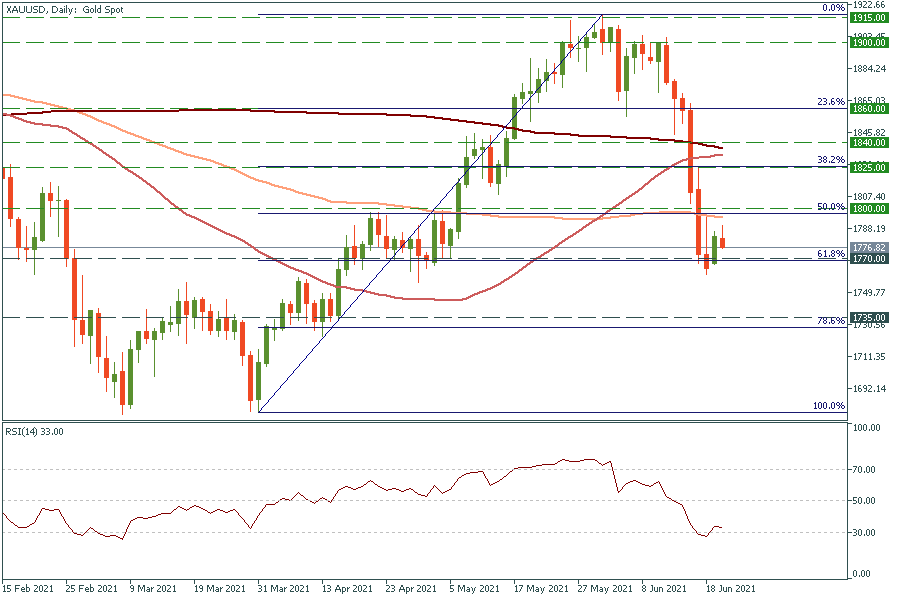

Gold has reversed up from the 61.8% Fibonacci retracement level of $1770. It gets closer to the next key resistance level at the 50% Fibo level of $1800 and the 100-day MA. It won’t cross it on the first try, but if it does, the way up to the 38.2% Fibo levels of $1825 will be clear.

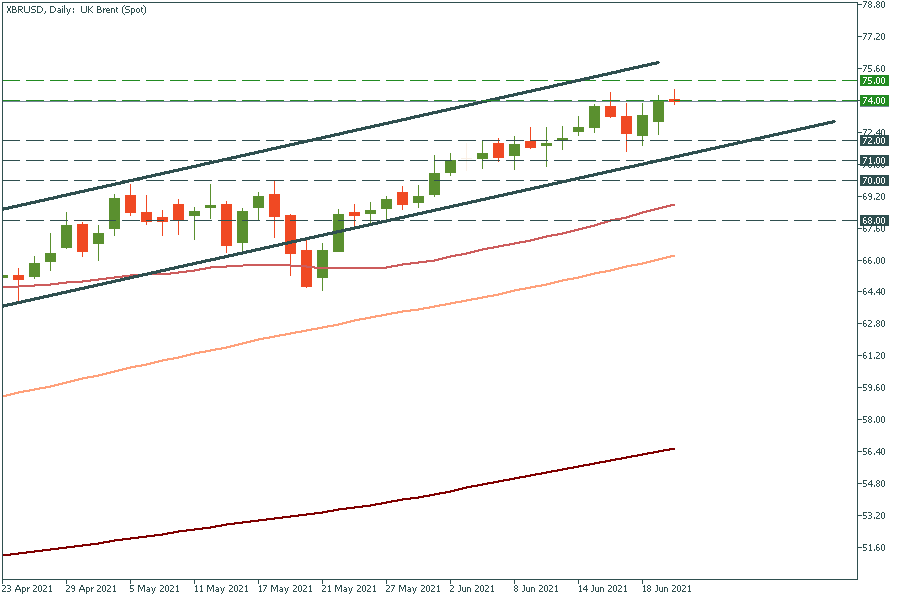

Brent oil (XBR/USD) has broken above $74.00 and rallies up towards the next round number of $75.00. According to banks such as Citi, Bank of America, and Goldman Sachs, the oil will rally above $80.00 this year. Support levels are $72.00 and $71.00 – the recent lows.