Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

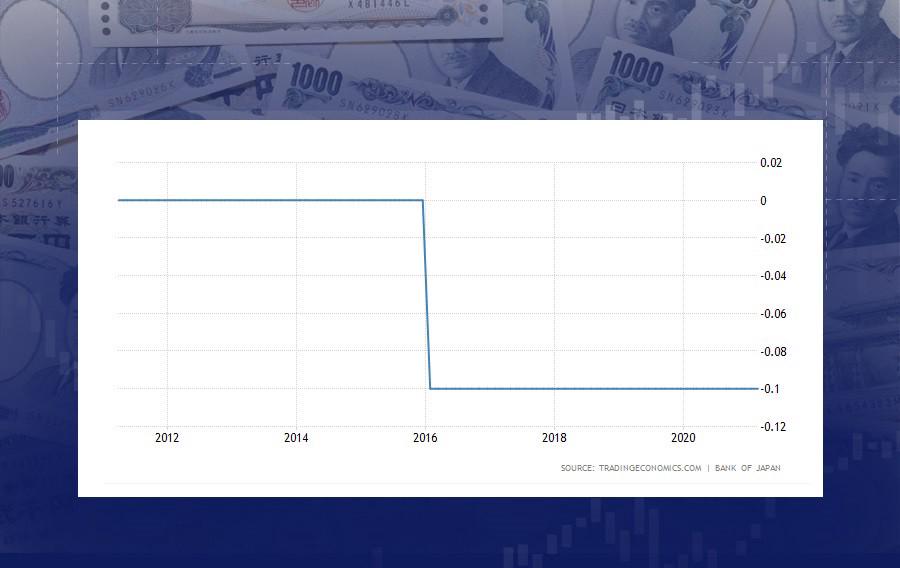

Personal areaBOJ shares its interest rate and monetary policy on March 19.

Bank of Japan is likely to keep the rate steady at -0.1%. Last time, the Bank revised the earlier projections of the yearly GDP growth rate (fiscal year April 2021 – April 2022) of 3.6% to a higher mark of 3.9% reflecting effective government measures against the virus fallout. In 2020, the Bank increased its quantitative easing through wider asset-buying and other measures adding that it would be standing by to further assist the economy if needed.

With the Bank of Japan, you would be looking at the status and dynamics of quantitative easing – particularly, if there is any prospect of increasing or decreasing any of its major elements.

Instruments to trade: USD/JPY, EUR/JPY, NZD/JPY, CHF/JPY