Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaGold is climbing up. If it manages to break the 50-day moving average of $1750, it may jump to the key level of $1760, which it’s unlikely to cross on the first try, but if it does, it may rocket to the next resistance of $1790. On the flip side, if it bounces off the 50-day MA at $1750 and turns down, it may drop to the support of $1730 which lies at the level of recent lows.

USD/JPY is moving inside the descending channel. It’s going back and forth under the resistance of 109.00. If it breaks it, the way up to the upper trend line at 109.25 will be open. On the flip side, the move below the low of March 24 at 108.65 will press the pair down to the 108.40 support.

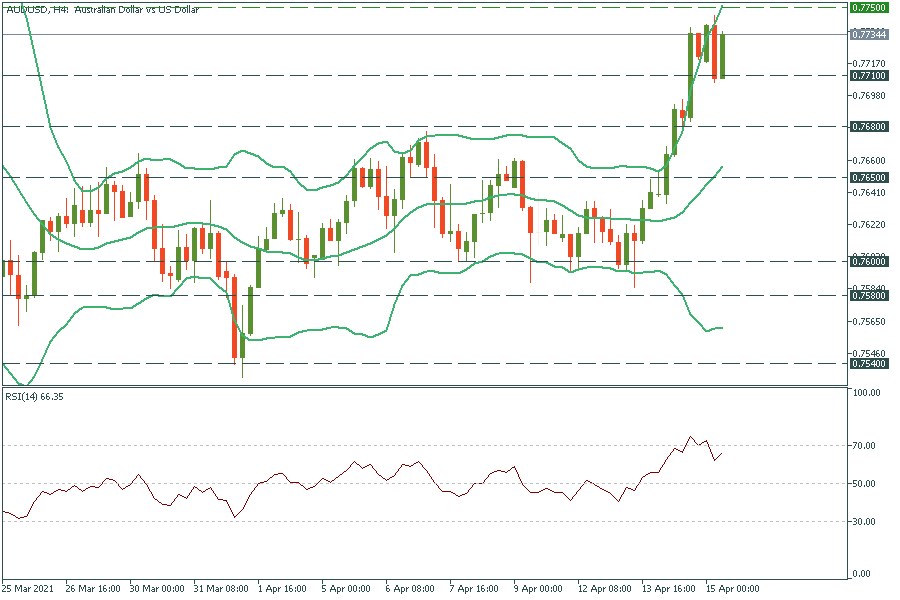

AUD/USD is getting back up! If it manages to break the resistance of 0.7750, it may rally up further to the high of March 18 at 0.7800, but be cautious as the RSI indicator is close to the 70.0 level. Once it’s crossed, the pair is likely to reverse down. Thus, the 0.7750 resistance may stop the pair from rising. Support levels are at the recent lows of 0.7710 and 0.7680.