Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

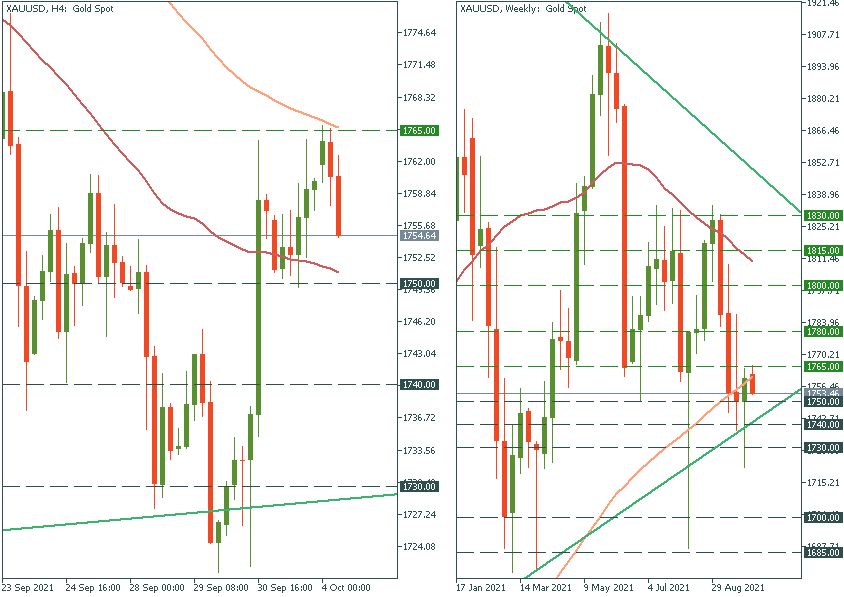

Personal areaGold is trying to recover the losses. On the weekly chart, it is moving sideways near the 100-week moving average just below $1760. On the 4-chart, we see that gold has reversed down from the 100-period moving average of $1765 and edging lower to the 50-period MA of $1750, where the metal should stop falling. The breakout below this support level will open the doors to the low of September 23 at $1740. Resistance levels are the 100-period MA of $1765 and the high of September 22 at $1780.

Here is a very strong movement in the JP 225 chart. The Japan index has massively dropped to the 50-week moving average of 28,200, which may stop the index from falling further. If it manages to close below this support level, it will drop to 27,650 – the lows of late August.