Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD had a huge swing up after the Fed report but failed to cross the 38.2% Fibonacci retracement of 1.1990. If it manages to do so, the way up to the 50.00% Fibo level of 1.2040 will be open. On the flip side, the move below the intraday low of 1.1955 will drive the pair down to the 50-period moving average of 1.1930.

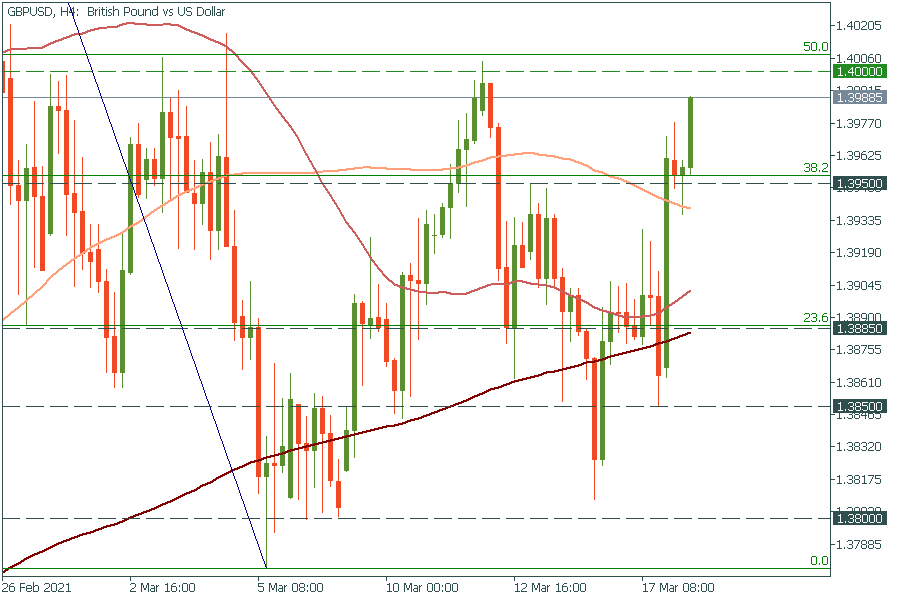

GBP/USD has broken through the 38.2% Fibonacci retracement of 1.3950. So, the way up to 1.4000 is open! However, it shouldn’t cross this resistance on the first try as it lies at the 50% Fibo level. Support levels are 1.3950 and 1.3885.

USD/CAD has broken through the psychological level of 1.2400, the level unseen since January 2018. Thus, the way down to the next round number of 1.2300 is open now. However, the RSI indicator has almost crossed the 30.0 level, an indication the pair is oversold. Thus, the reverse up may happen soon. Resistance levels are at the recent highs of 1.2735 and 1.2875.

AUD/USD has approached the 61.8% Fibo level at 0.7840. If it breaks it, it may jump to the 78.6% FIbo level of 0.7910. Support levels are 0.7785 and at the 50-day moving average of 0.7730.

Follow the Bank of England’s meeting at 14:00 MT and keep an eye on the GBP!