Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD retraced to 1.1870 after breaking out this level. It should be just a natural sell-off ahead of the further rally up. The 1.1870 level was acting as resistance before, but now this level has become support. Moreover, there is a 200-period moving average below it, making this level even harder to break. Thus, there is a high probability that the pair reverses up. If it crosses the psychological mark of 1.1900, it may jump to the 38.2% Fibonacci retracement level of 1.1950.

Read more about how to trade retracements.

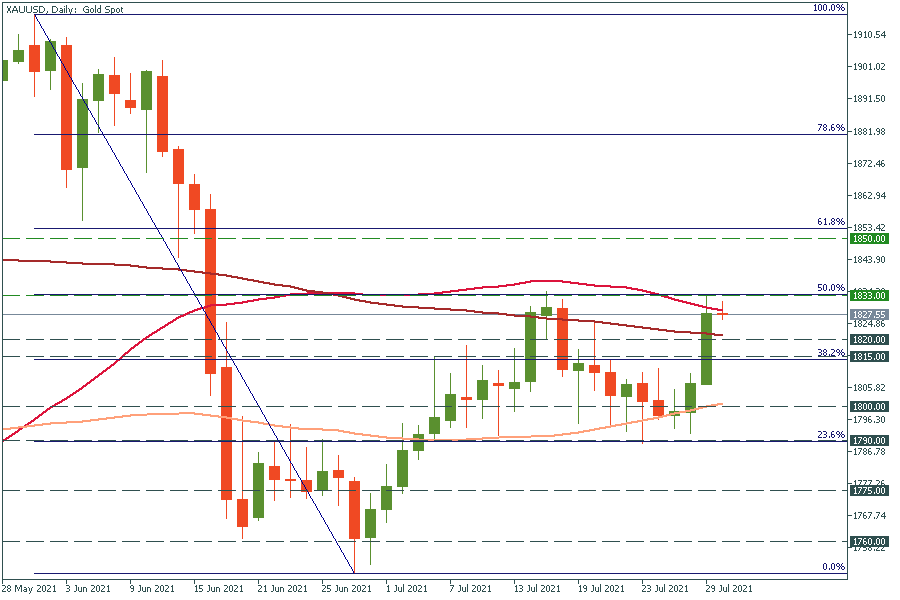

Gold has reversed down from the 50.0% Fibonacci retracement level. It’s moving down to the 200-day moving average at $1820. The move below it will open the doors towards the 38.2% Fibonacci retracement level of $1815. On the flip side, if the yellow metal breaks above the $1833 resistance level, it will rally up to $1850.

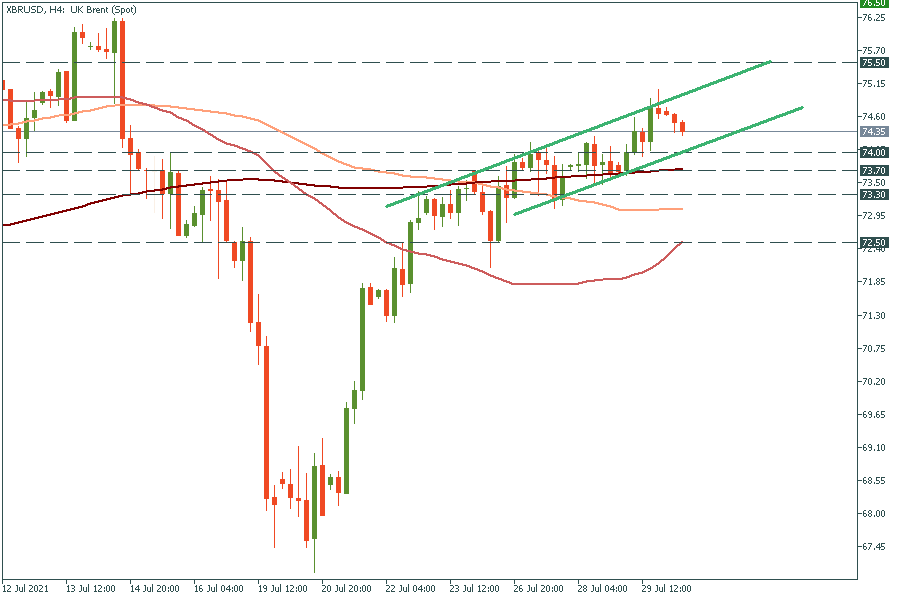

Now is the best time to trade XBR/USD (Brent oil). It’s moving back and forth inside the ascending channel. Now it reversed down from the upper trend line and it’s likely to fall to the lower one at $74.00. After that, it will bounce off the lower trend line and reverse up.