Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

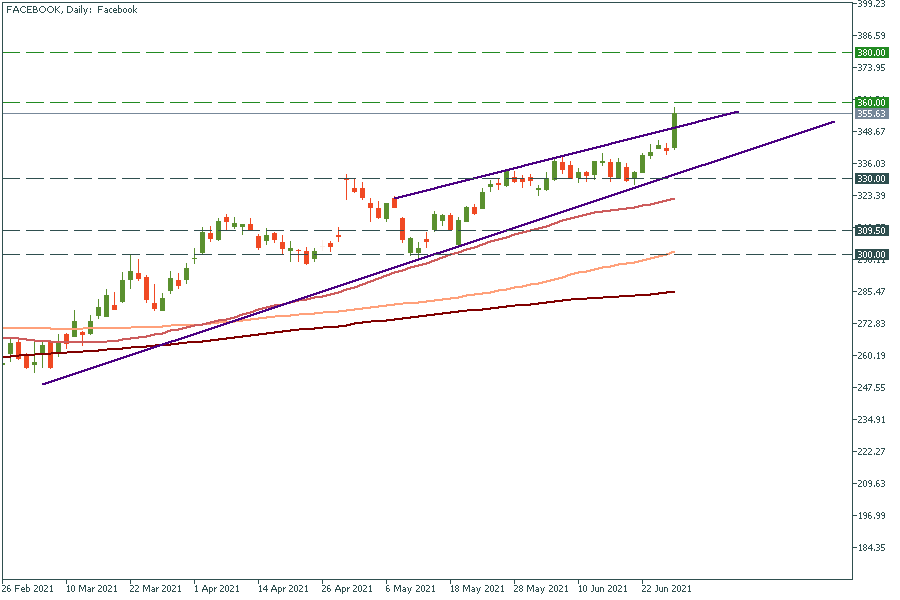

Personal areaOn June 28, the capitalization of Facebook reached $1 trillion, making it the fifth-biggest US company together with Apple, Microsoft, Amazon, and Alphabet. The stock of Facebook closed at the new highs of $355.63. Why did this sudden optimism happen around the controversial name of the infamous social media developer? The rally was provoked by the US Federal Court’s decision yesterday that dismissed two antitrust lawsuits against Facebook. In December, the US Federal Trade Commission (FTC) sued social media giant for anticompetitive behavior. Now, 6 months later, U.S. District Judge James E. Boasberg said the FTC failed to provide evidence that FB controlled 60 percent of the social media sector. He gave the agency 30 days to make an amended complaint and provide more details.

Despite lawsuits, the social media owner posted encouraging financial data over the last four quarters. The company’s revenue outperformed Wall Street’s estimates and reached $26,171 billion in the first quarter of 2021 with earnings per share at 3.30. Analysts expect the next earnings to be as good as the previous ones. They anticipate the revenue of $27,802 and EPS at 3.03. This makes Facebook stock an attractive investment these days. The release date of earnings data is set for July 28.

After closing at $355.63, we may expect a short-term correction to the support of $330 when the market opens at 16:30 MT (GMT+3) time. If the $360 level is crossed, the next potential target in focus will be located at $380.

Don't know how to trade stocks? Here are some simple steps.