Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaFederal Reserve will make a statement on November 3, 20:00 GMT+2. There we will hear about Fed’s view on the current economic situation, tapering plans, and other hawkish or dovish tones. The FOMC usually changes the statement slightly at each release. Traders focus on these changes. In 30 minutes FOMC will hold a press conference that lasts about an hour long and has 2 parts - first, a prepared statement is read, then the conference is open to press questions.

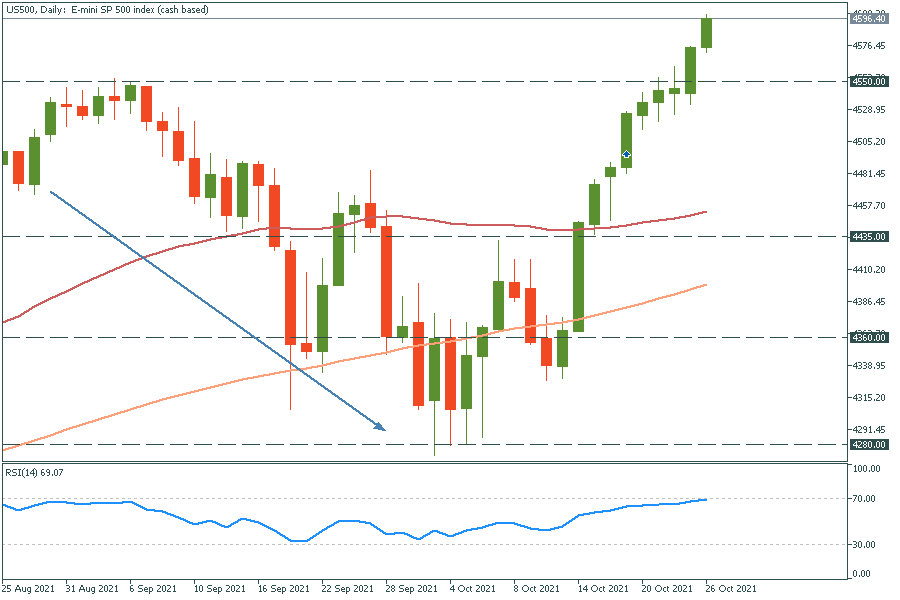

First, this statement is the primary tool the FOMC uses to communicate with investors about monetary policy. The decisions made this day not only add volatility to the market but also can change the game. For example, when FOMC started to talk about tapering seriously (August-September 2021), S&P 500 had a 6% correction that lasted for more than a month. Second, the questions at the press conference often lead to unscripted answers that create even more volatility.

The main affected assets are US 500 (S&P 500) and US 100 because tapering news affects the stock market directly. Also, gold tends to have an inverse correlation with USD, and USD tends to rise on tapering plans.

Check the economic calendar

Instruments to trade: EUR/USD, US 500, US 100, XAU/USD.