Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

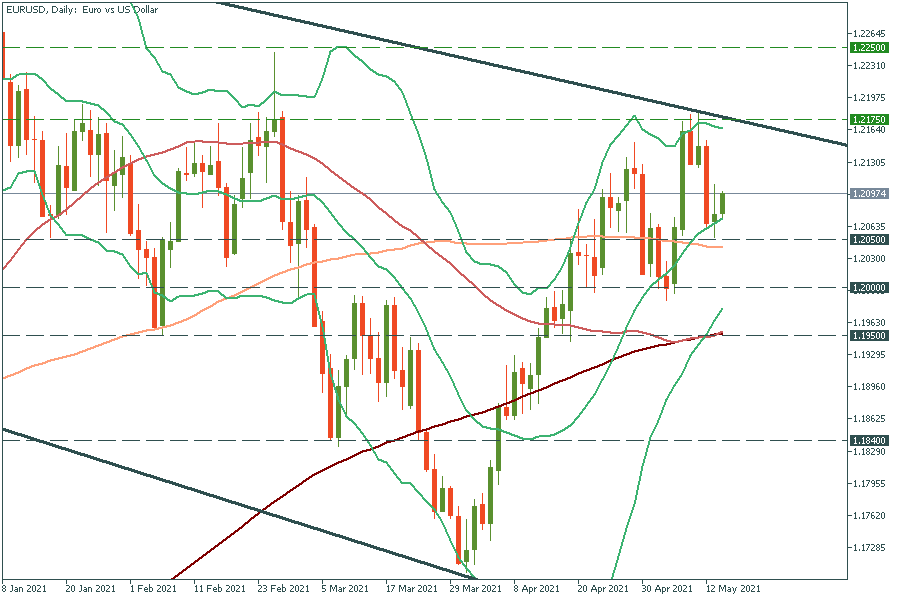

Personal areaEUR/USD has bounced off the 100-day moving average of 1.2050 and started edging higher. It may rise to the upper trend line of 1.2175, which the pair should fail to cross on the first try. On the flip side, if it drops below the 1.2050 support, it may fall to the low of May 5 at 1.2000.

Oil is trying to recover from yesterday’s losses. XBR/USD (UK Brent oil) has bounced off the lower trend line several times already, that’s why we would expect it to reverse from this lower trend line. On the way up, the oil will meet resistance levels at the 50-period moving average of $68.30 and the psychological mark of $70.00. However, if it drops below the 200-period moving average of $65.60, it may fall to late-April lows.

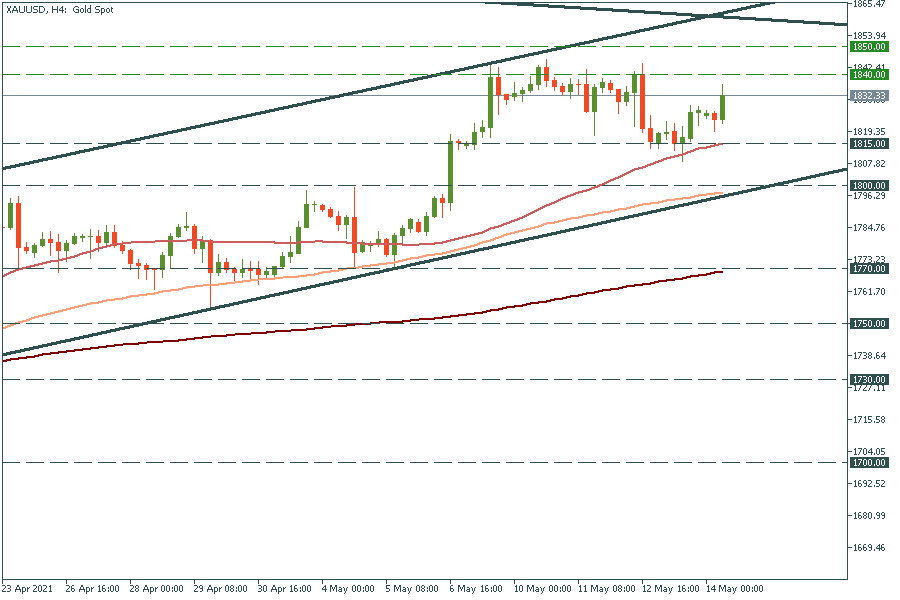

Gold has reversed up from the 50-period moving average of $1815. The way up is clear to the recent highs of $1840, but this level lies at the 50-week moving average (to see ait switch to the weekly chart). Thus, gold may struggle to cross it. Support levels are $1815 and $1800.