Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

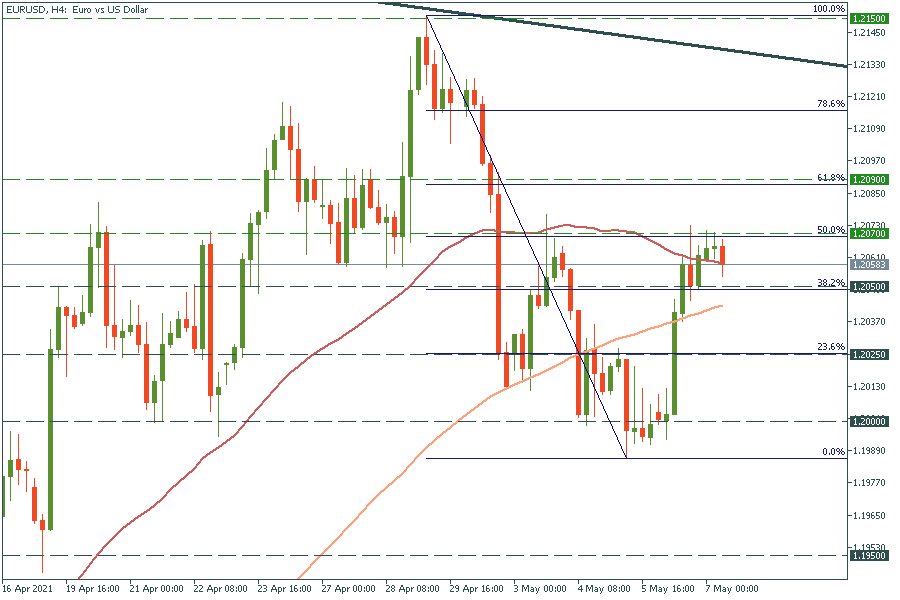

Personal areaEUR/USD has failed to break the 50% Fibonacci retracement level of 1.2070. If it manages to break it, the way up to the 61.8% Fibo level of 1.2090 will be open. On the flip side, the move below the 38.2% of 1.2050 will drive the pair down to the next support of 1.2025.

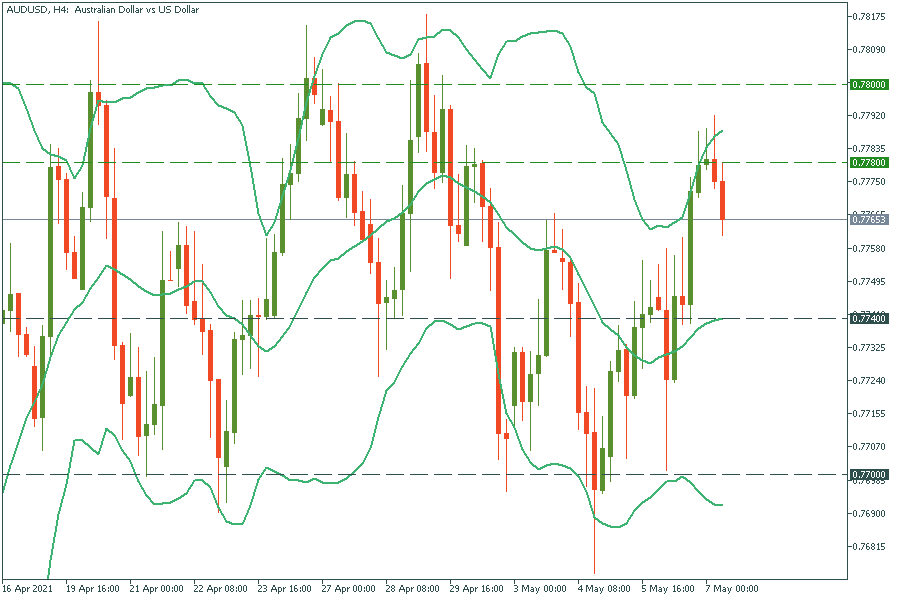

It’s so easy to trade AUD/USD with the Bollinger Bands (BB) these days! The pair is like a ball, which is bouncing off the lines of BB. It has just reversed from the upper line, which acts as a resistance. Therefore, the way down to the middle line of 0.7740 is open now, where the price may stop and you should wait for the next price movement. If it bounces off, it will turn to the upside and may retest 0.7780 – the recent high. If it breaks through the mid-line, it will fall to the lower line of the BB at 0.7700.

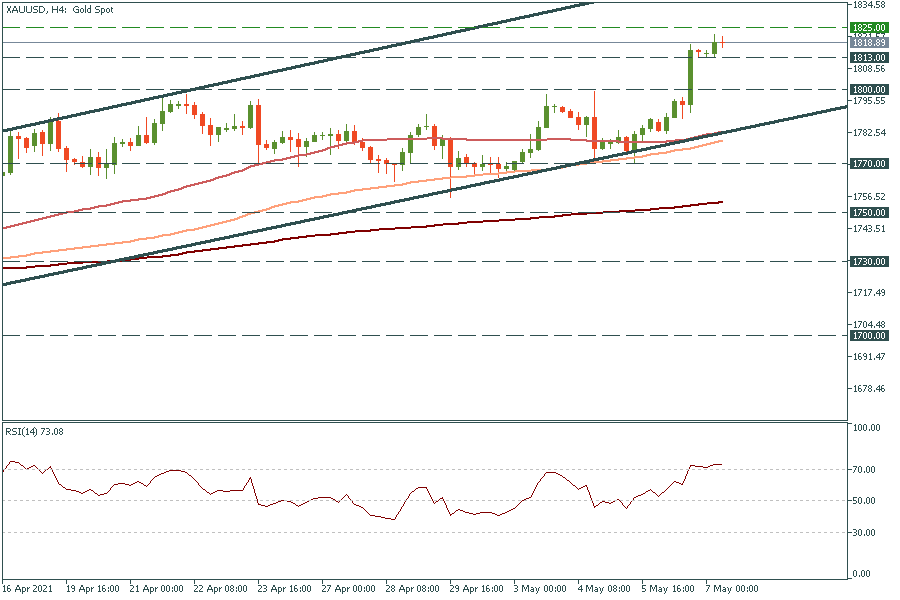

Gold has skyrocketed and even crossed the psychological mark of $1800 yesterday. After that, it took a pause, but if bulls keep momentum and the price breaks the resistance of $1825, the way up to the next round number of $1850 will be open. Pay attention that the RSI indicator went above 70.00 level, signaling the asset is overbought, thus we shouldn’t expect a long rally up. Support levels are the intraday low of $1813 and the $1800 support.