Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

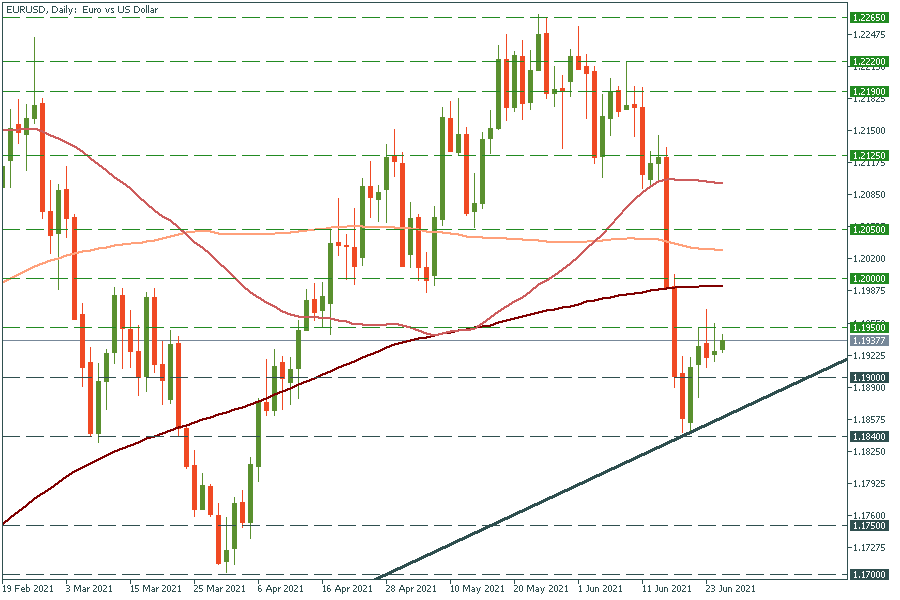

Personal areaEUR/USD keeps attacking the resistance level of 1.1950. If it finally manages to break it, the way up to the 200-day moving average of 1.200. will be open. On the flip side, the move below the 1.1900 support will press the pair down to Monday’s low of 1.1840.

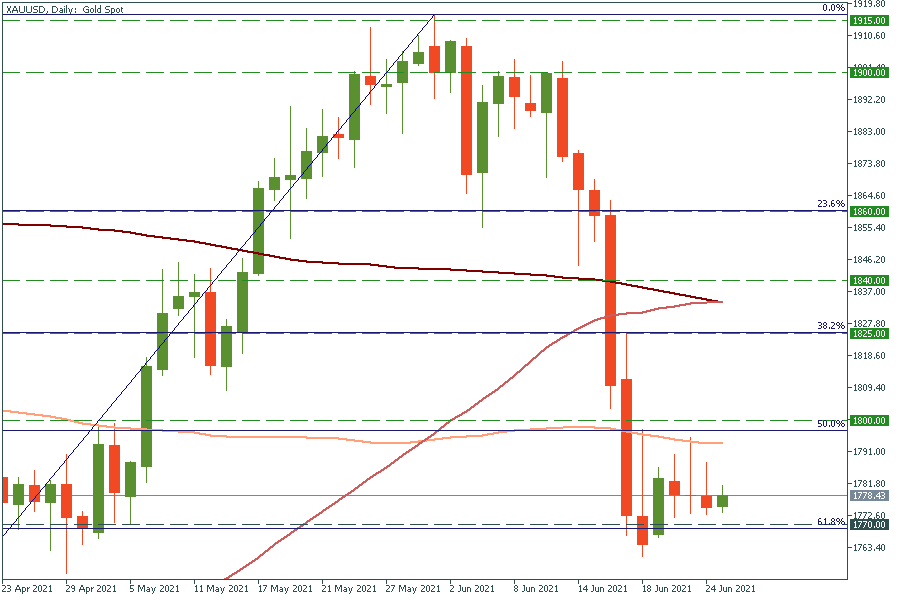

Gold is moving back and forth between $1770 and $1800. The Fed’s plans to cut bond buys in the coming months lifted the US dollar and thus pressed down gold. The long upper shadows of the last candlesticks signal that bulls (buyers) were trying to push the price higher, but by the end of the session more bears (sellers) appeared and higher prices were rejected. Thus, gold is likely to fall further. The move below the 61.8% Fibonacci retracement level of $1770 will press gold down to the 78.6% Fibo levels of $1735. Resistance levels are $1800 and $1825.

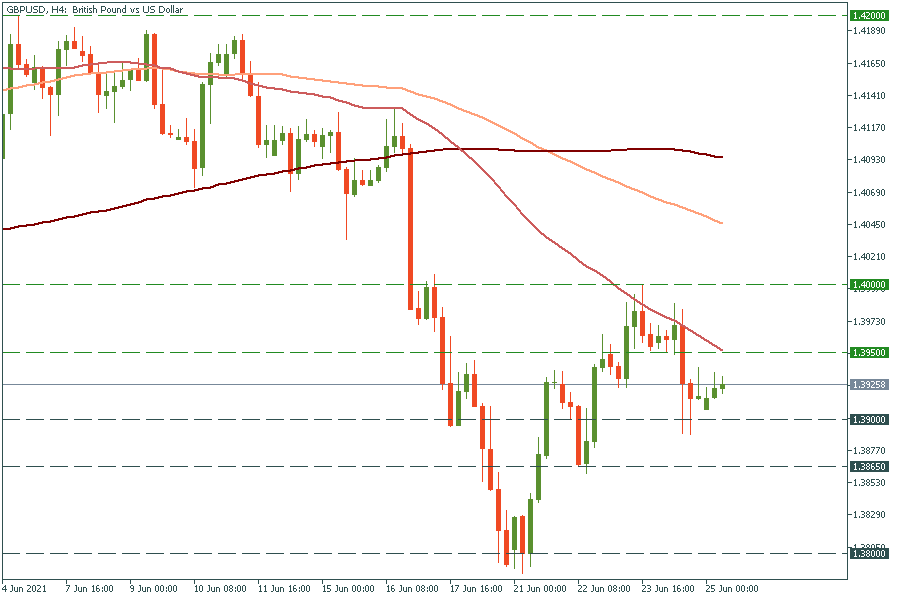

GBP/USD has reversed up from the 1.3900 support. Now it’s getting closer to the 50-period moving average of 1.3950, which it’s unlikely to cross on the first try as it has failed to break it a few times before. Besides, the hawkish Fed and dovish Bank of England are likely to press GBP/USD down. The move below 1.3900 will open the doors to the low of June 22 at 1.3865.