Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD is moving inside the descending channel. Since it’s in the upper part of the channel, the pair is likely to reverse down soon. However, where the price will head further hugely depends on the Fed’s decision this evening. If it hints at soon tapering, the USD will rise. Otherwise, if the bank stays dovish, the USD will fall. The move below the 100-period moving average of 1.1810 will open the doors lower to the 50-period MA at 1.1790. Resistance levels are at the recent high of 1.1835 and the next round number of 1.1850.

Gold has reversed up! It was trading sideways below $1815 for a while. If it finally manages to break the resistance zone of $1808-1815, it will rocket to the 50.0% Fibonacci retracement level of $1833. Support levels are at the recent low of $1795 and the 23.6% Fibo level of $1790.

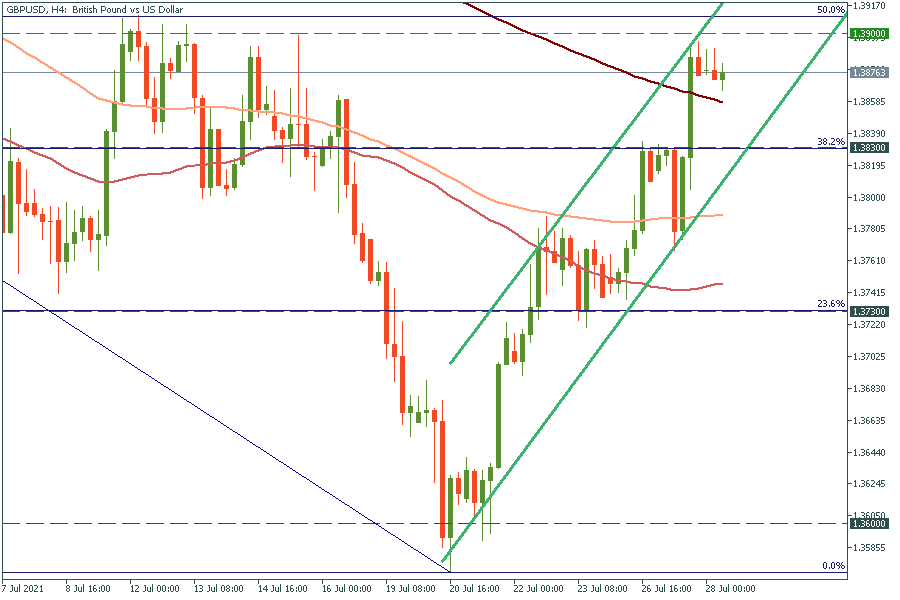

Finally, let’s discuss GBP/USD. It has reversed down from the 50.0% Fibonacci retracement level of 1.3900. Thus, it may fall to the 38.2% Fibo level at 1.3830, where the fall should stop. On the flip side, the move above the 50.0% Fibo level of 1.3900 will open the doors to the next round number of 1.3950.