Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal area

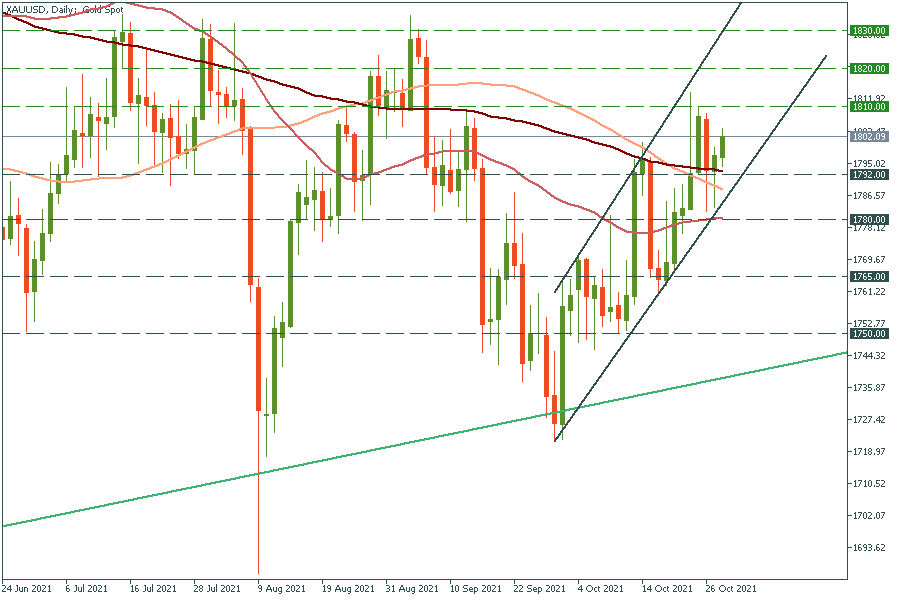

Gold keeps moving inside the ascending channel. It has surged above the psychological mark of $1800 and edged higher to the high of October 25 at $1810. If it manages to jump above this resistance level, the metal will rocket to the next round number of $1820. Support levels are the 200-day moving average of $1792 (which also lies at the lower line of the channel) and the 50-day moving average of $1780.

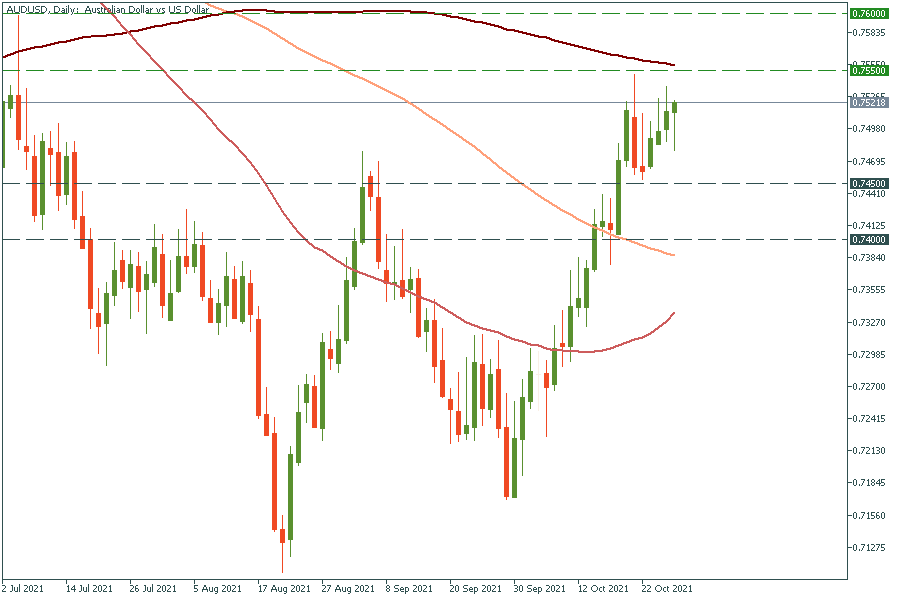

AUD/USD has surged above 0.7500. It will struggle to break the resistance level of 0.7550 at the 200-day moving average, but if it manages to break it, the way up to the four-month high of 0.7600 will be open. Support levels are 0.7500 and the low of October 22 at 0.7460.