Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

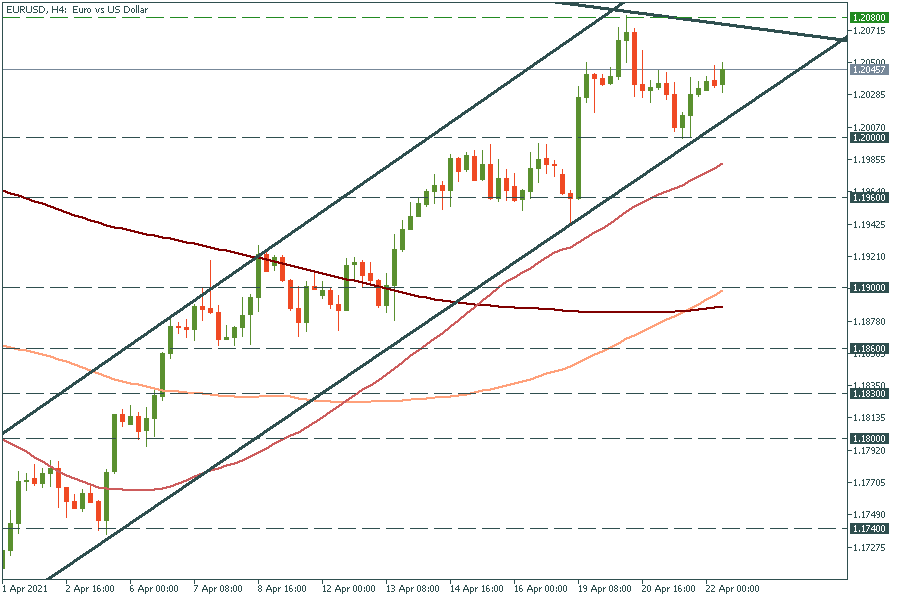

Personal areaEUR/USD is moving in a downtrend in the long term, but the short-term trend is upward. Today, the ECB meeting may increase the volatility. If the price manages to cross the recent high of 1.2080, it may rally up to the next resistance of 1.2175, which lies at January-February highs. However, if it crosses the support of 1.2000, it may fall to the low of April 19 at 1.1960.

Gold has broken through the resistance of $1790 and retraced to it. It should be just a natural sell-off after the breakout. Thus, gold may rally up further to the late February highs of $1815. However, if it drops below $1790, it may fall to yesterday’s low of $1775.

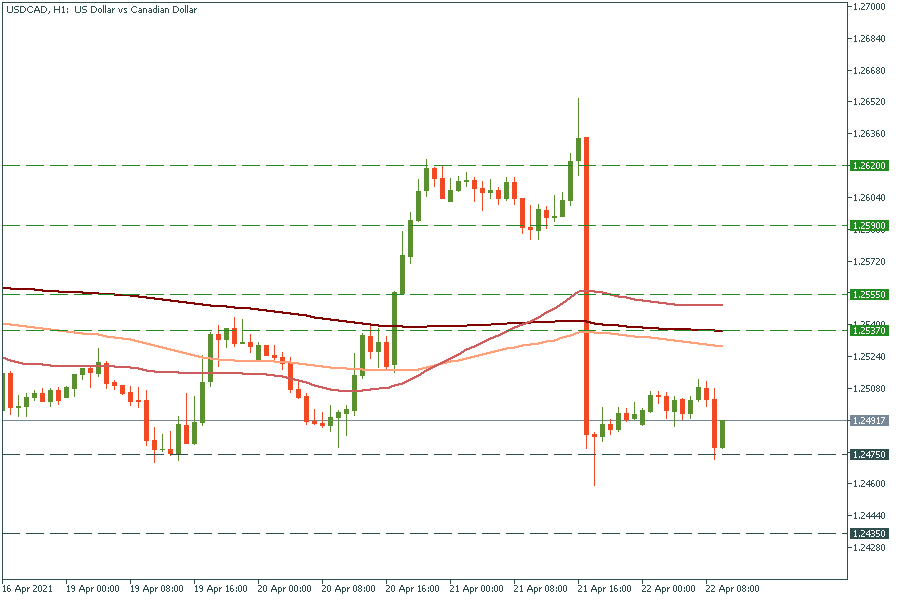

USD/CAD is steadily moving down in the long term. Yesterday, the hawkish move of the Bank of Canada underpinned the CAD and thus pushed USD/CAD down. If it manages to drop below the recent low of 1.2475, it may fall to the low of March 16 at 1.2435. The upside is limited moving averages at 1.2537 and 1.2555.

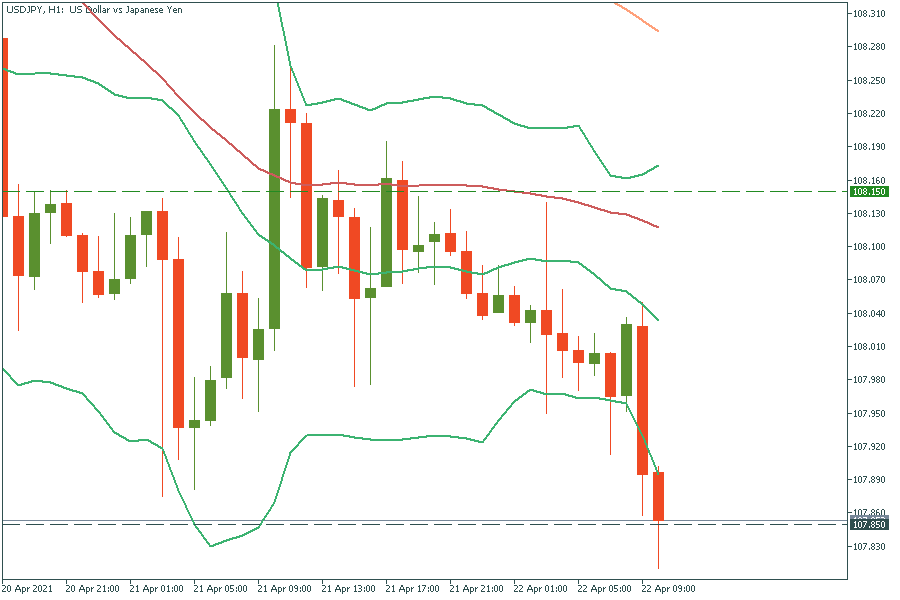

Finally, let’s discuss USD/JPY. It has failed to cross the middle line of Bollinger Bands several times already. Thus, we might expect that this will happen again and the price reverses down from 108.15. But if it manages to cross it, the way up to the upper trend line of 108.50 will be open. If it breaks the lower line of Bollinger Bands at 107.85, the way down to the next round number of 107.50 will be open.