Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

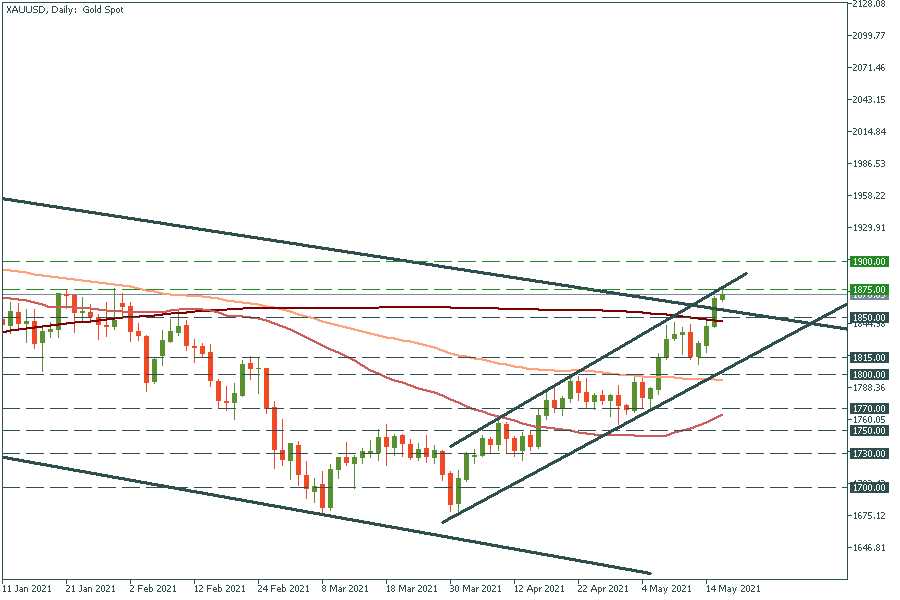

Personal areaWell, let’s start with gold today! It has broken through the upper trend line and now it’s just below the $1875 resistance – the highs of late January. If it manages to break it, the way up to the psychological mark of $1900 will be open. However, the rally up was quite long, that’s why we might see some short sell-off, maybe pullback to $1850 – the 200-day moving average.

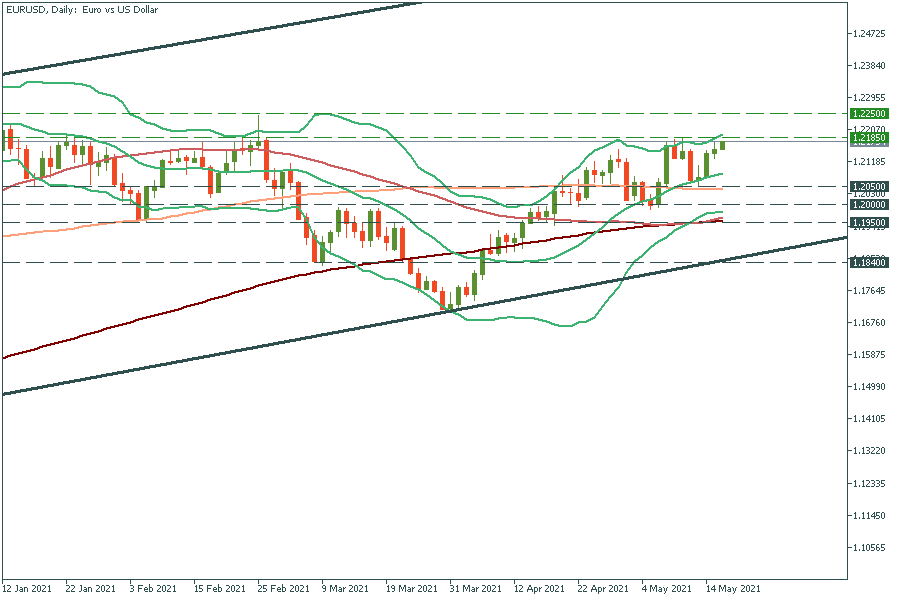

If EUR/USD crosses the recent highs of 1.2185, it may jump to the high of February 25 at 1.2250. Since the pair is trending up both in the long and the short term and the USD is weak today, it’s likely to do that. On the flip side, the move below the 100-day moving average of 1.2050 will press the pair down to the 1.2000 support.

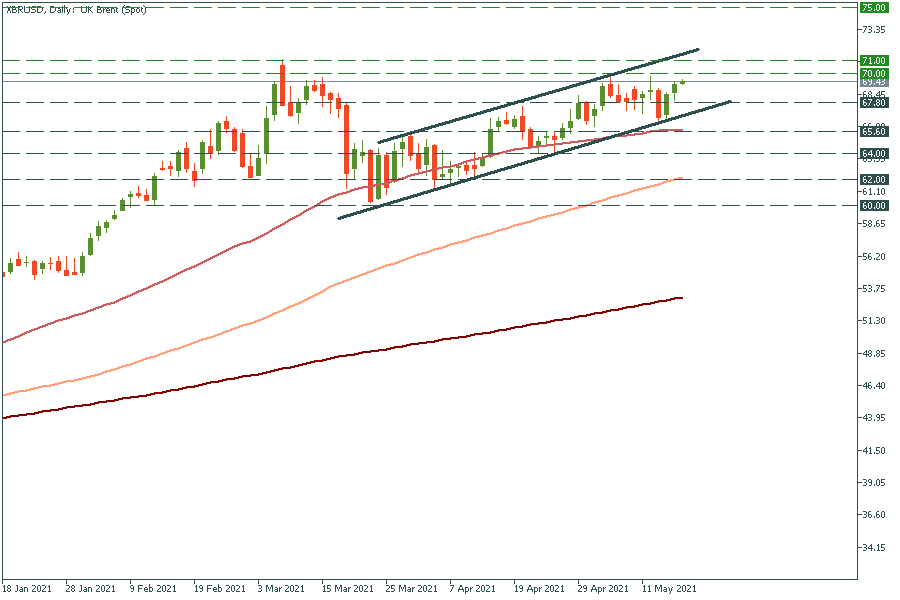

XBR/USD (UK Brent oil) has approached the key resistance of $70.00. The breakout above this level will drive oil up to the high of March 8 at $71.00. Support levels are $67.80 and $65.60 at the 50-day moving average.

Tesla has reversed from $560.00 yesterday and recovered some losses, but today after Burry sold so many Tesla’s shares, we might expect the stock to drop to $550.00 and then maybe deeper to $500.00. Resistance levels are at the recent highs of $600.00 and $620.00.