Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

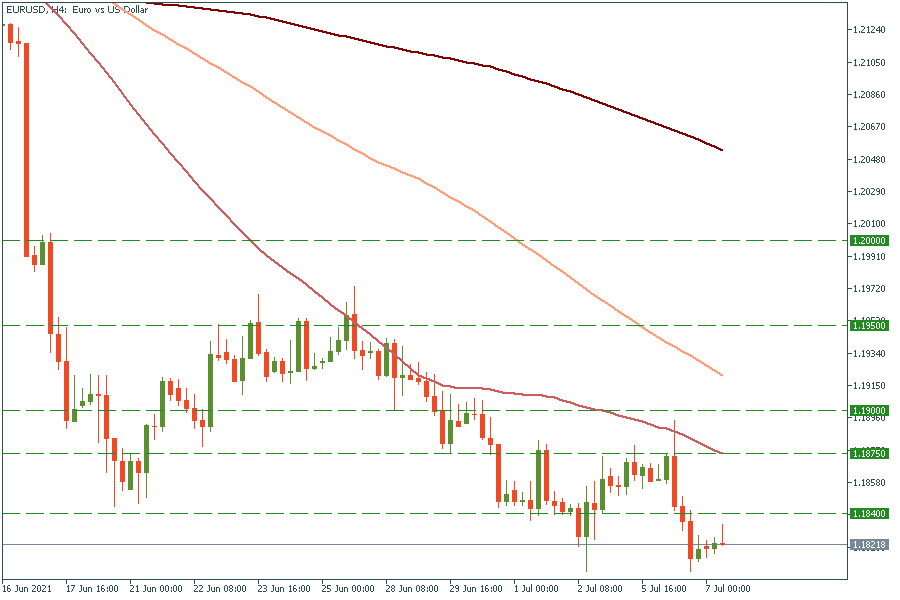

Personal areaEUR/USD is moving down. The breakout below the psychological mark of 1.1800 will press the pair down to the next round number of 1.1750. On the flip side, if the pair breaks above the resistance level of 1.1850, the way up to the 50-period moving average of 1.1875 will be open. Notice that the pair has failed to break above the 50-period moving average many times already, that’s why even if the pair approaches it, it will reverse down from it.

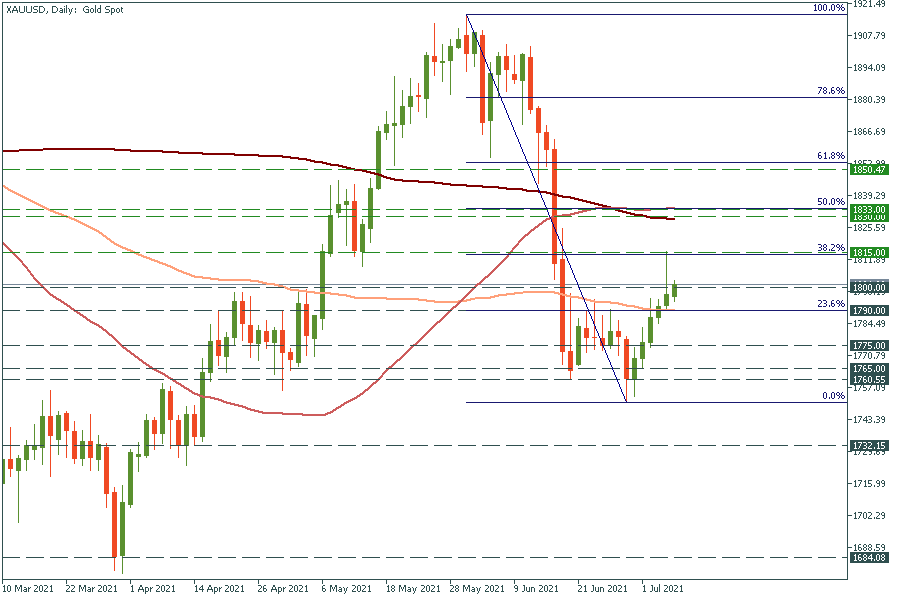

Gold has broken above $1800. The doors are open towards the 38.2% Fibonacci retracement level at $1815. If gold crosses this mark, it may jump to the key resistance zone of $1830-1833, which will be hard to cross as it’s a 50% Fibo level. Support levels are $1790.00 and $1775.

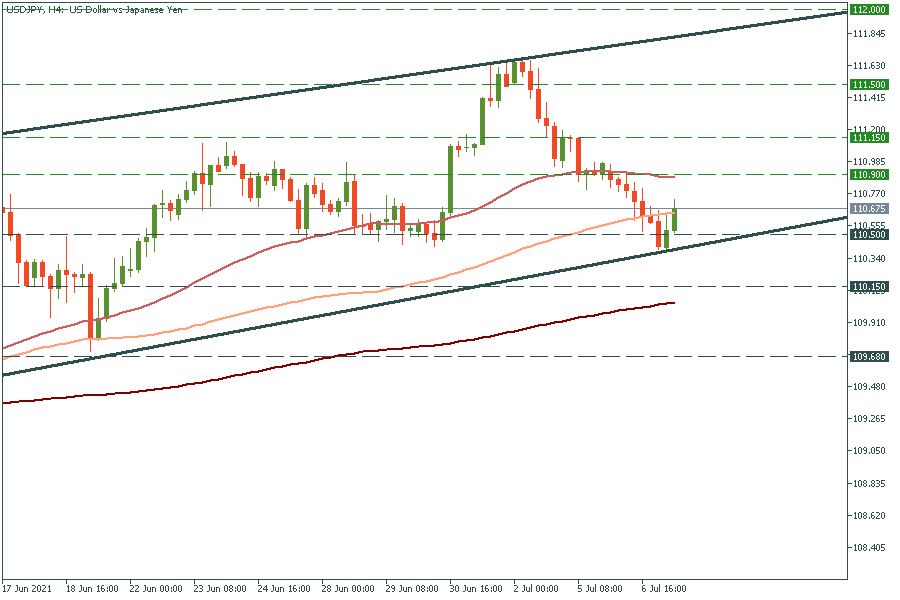

USD/JPY is moving inside the ascending channel. It has bounced off the lower trend line and now it’s getting closer to the 50-period moving average of 110.90. If it breaks it, it may jump to the high of June 5 at 111.15. Support levels are the lower trend line of 110.50 and the mid-June lows of 110.15.