Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

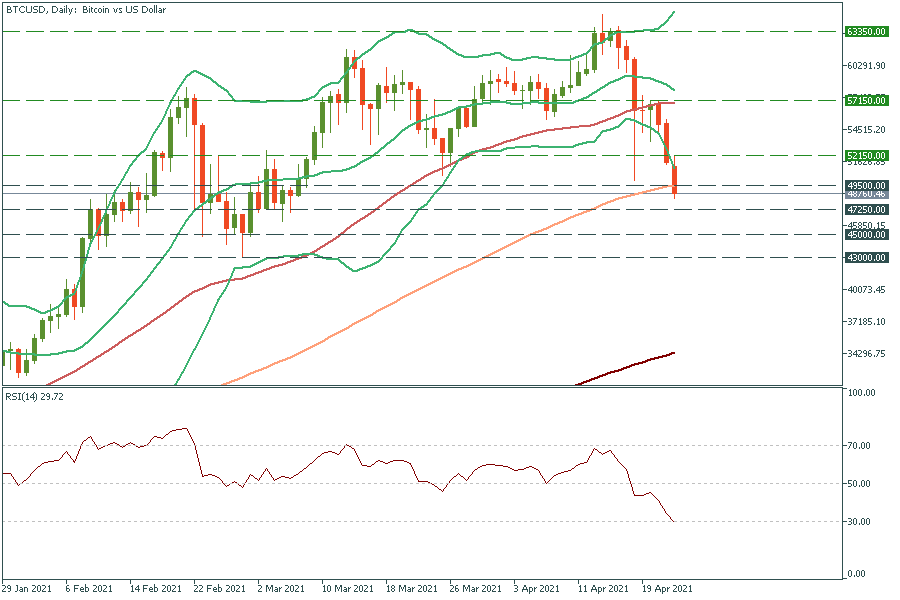

Personal areaBTC/USD has significantly dropped. Since the RSI has approached the 30.00 level (signaling that the price is oversold) and Bitcoin also fell below the lower line of Bollinger Bands, the reverse up may occur soon. It may reverse up from the 100-day moving average of $49,500. On the way up it will meet the resistance levels at the recent highs of $52,150 and $57,150. However, if it drops below the $49,500 support, it may fall to $47,250 and $45,000 – the March lows.

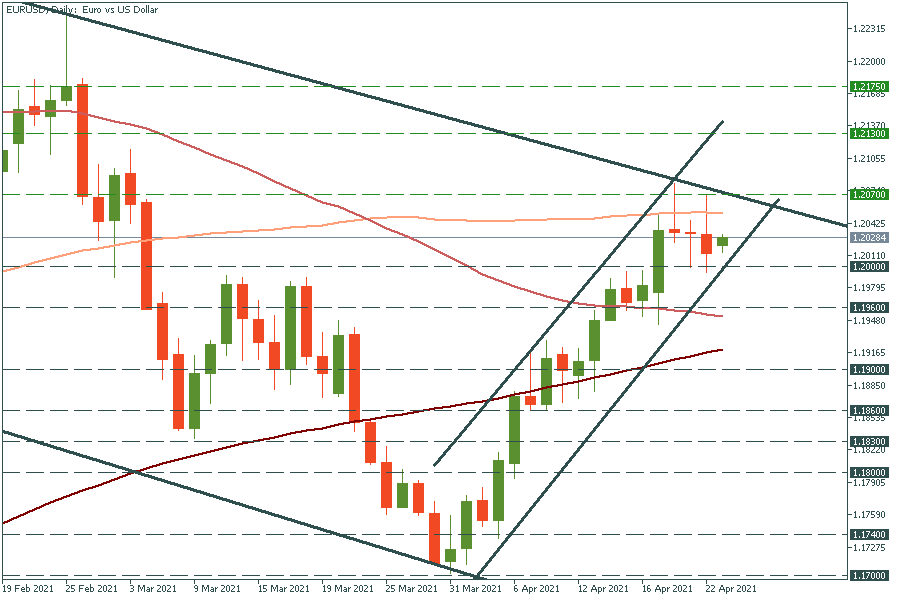

EUR/USD has started the day on a positive footing. If it manages to break the recent high of 1.2070, the way up to the two-months high of 1.2175 will be clear and then to the next support of 1.2130. On the flip side, if it drops below yesterday’s low of 1.2000, the way down to the 50-day moving average of 1.1960 will be open.

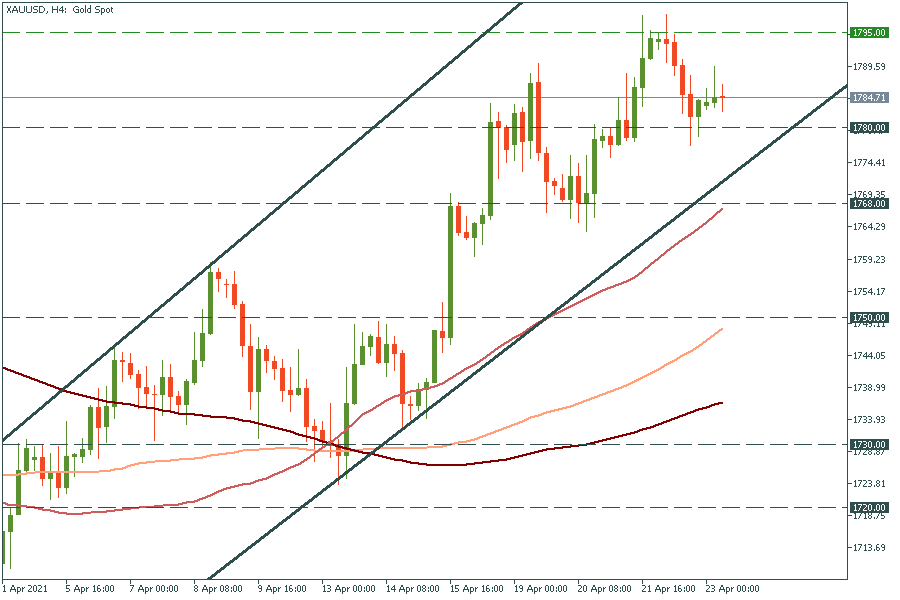

Gold keeps rising. If it crosses yesterday’s high of $1795, the way up to the one-month high of $1815 will be clear. In the opposite scenario, the move below the $1780 support will press the yellow metal lower to the 50-period moving average of $1768.

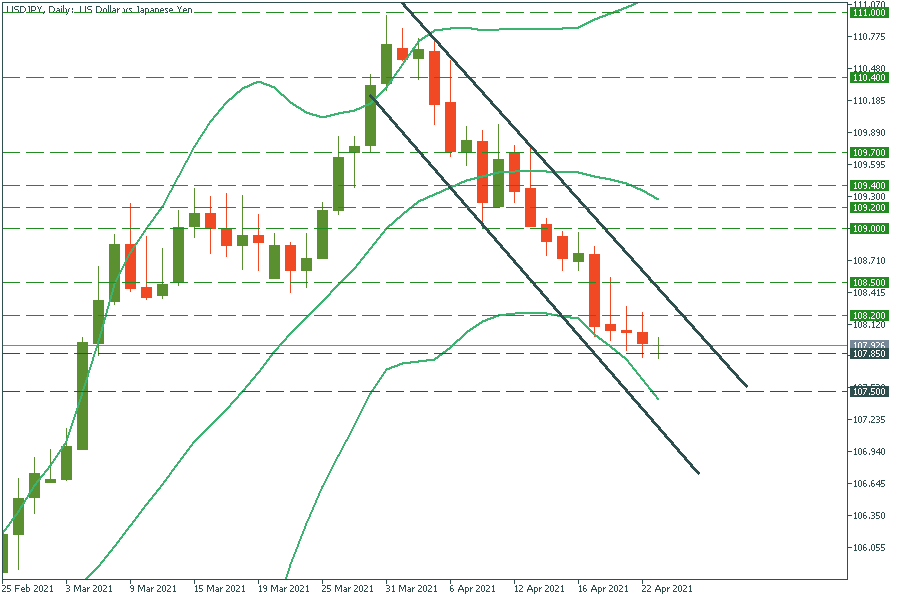

USD/JPY is edging lower and lower. If it breaks the 107.85 support, it may fall to the next round number of 107.50. However, if it breaks the recent highs of 108.20, it may jump to the 50-period moving average of 108.50.