Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

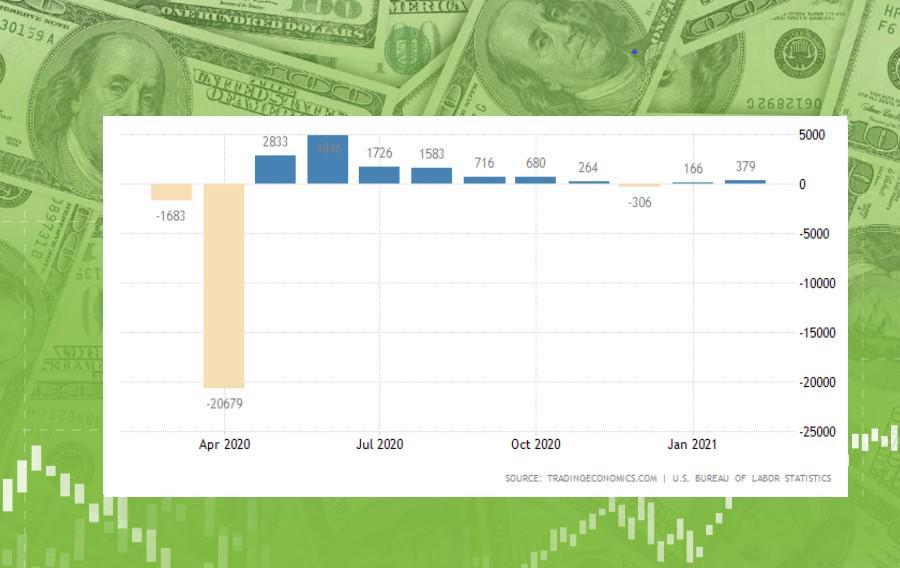

Personal areaThe United States will post the indicators of employment on April 2, at 15:30 MT time. You will get an opportunity to trade on the average hourly earnings, the unemployment rate, and, of course, on the non-farm payrolls (NFP). The last indicator tends to be the most important one. It represents the change in the number of employed people during the previous month without the farming industry. The US dollar reacts greatly to this data. Don’t downplay the importance of the other two indicators, though. Combined, they represent a significant fuel to the US currency. Last time, non-farm payrolls greatly outperformed the forecasts with an increase of 379K. The unemployment rate dropped to 6.2%. The only release that came out in line with the forecasts was the average hourly earnings. As a result, the USD strengthened.

There are different ways for taking advantage out of the NFP release. Pay attention to the economic calendar.

Instruments to trade: EUR/USD, GBP/USD, USD/JPY