Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

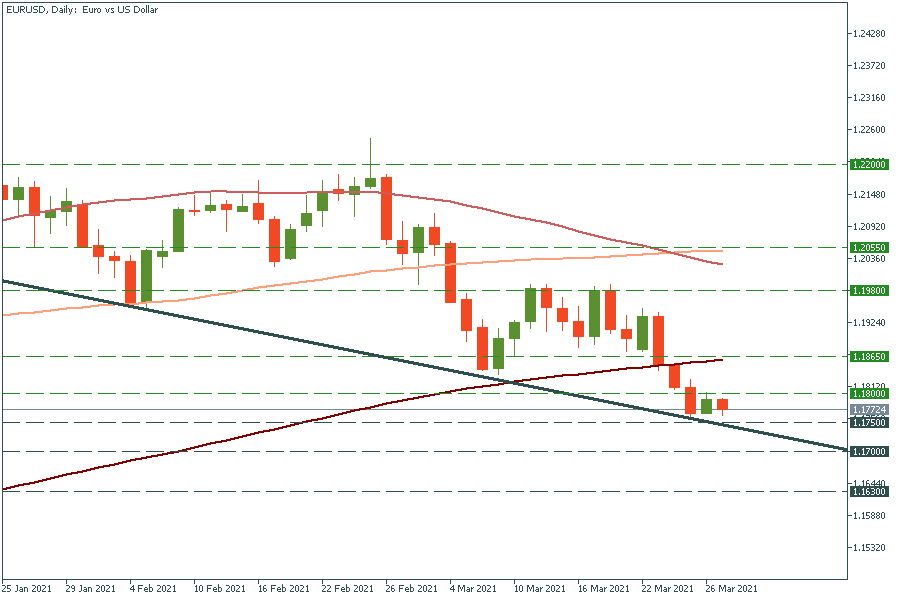

Personal areaEUR/USD has been moving down since the start of this year. If it manages to break the support of 1.1750, the way down to the psychological mark of 1.1700 will be clear. In the opposite scenario, the move above Friday’s high of 1.8000 will drive the pair to the 200-day moving average of 1.1865.

GBP/USD has been rising since Thursday, but still inside a descending channel. If it manages to break the 50-day moving average of 1.3840, the way up to 1.3900 will be clear. On the flip side, if it falls below Thursday’s low of 1.3680, it will open doors towards the 100-day MA at 1.3620.

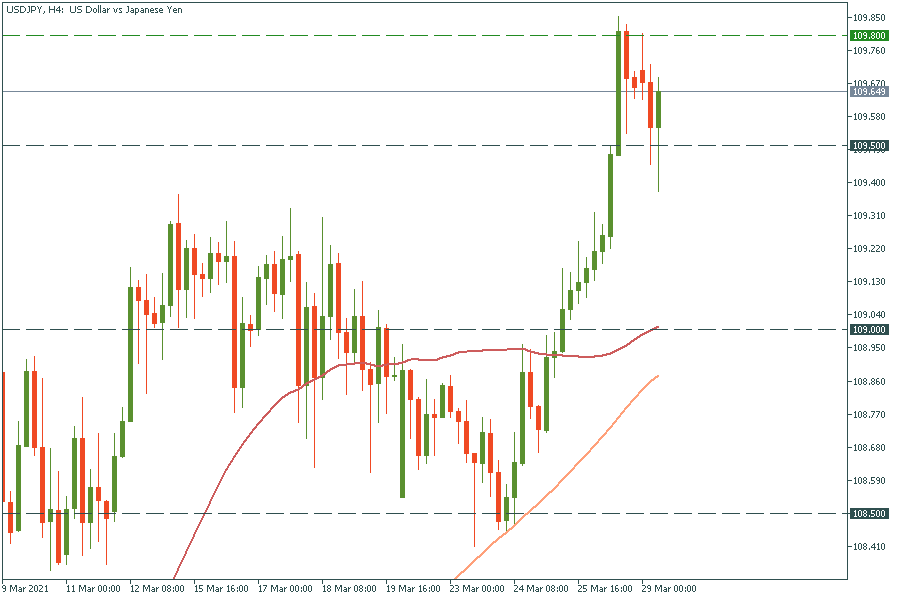

USD/JPY has retraced to the support of 109.50. If bulls keep momentum and the pair jumps above the intraday high of 109.80, the way up to the key psychological mark of 110.00 will be clear. In the opposite scenario, if it drops below 109.50, the way down to the 50-period MA of 109.00 will be clear.

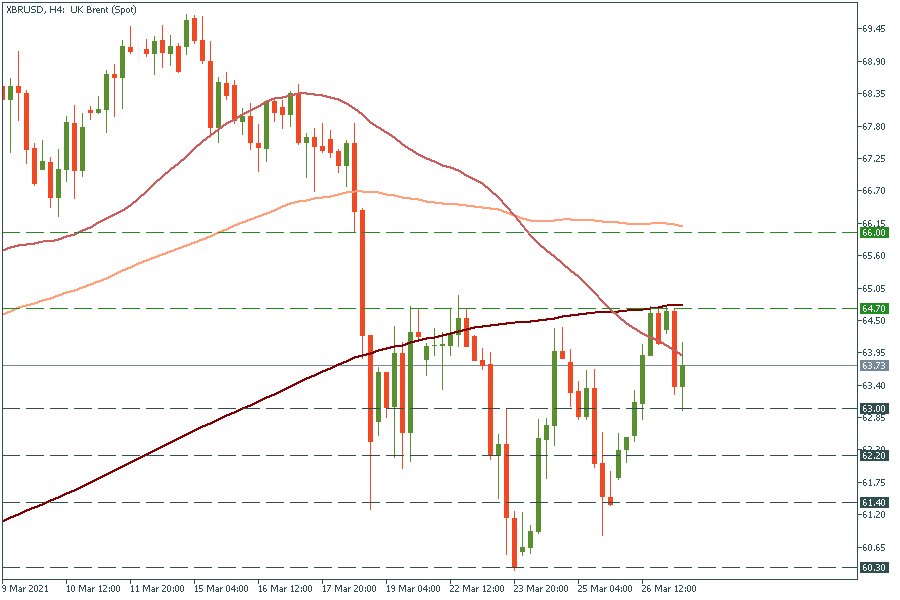

Finally, let’s discuss crude oil on the example of UK Brent oil or XBR/USD. It’s trying to recover its recent losses. If it jumps above the 200-period of $64.70, the way up to the 100-period MA of $66.00 will be clear. Support levels are at the recent lows of $63.00 and $62.20.