Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOPEC-JMMC is holding a meeting on April 28 all day long.

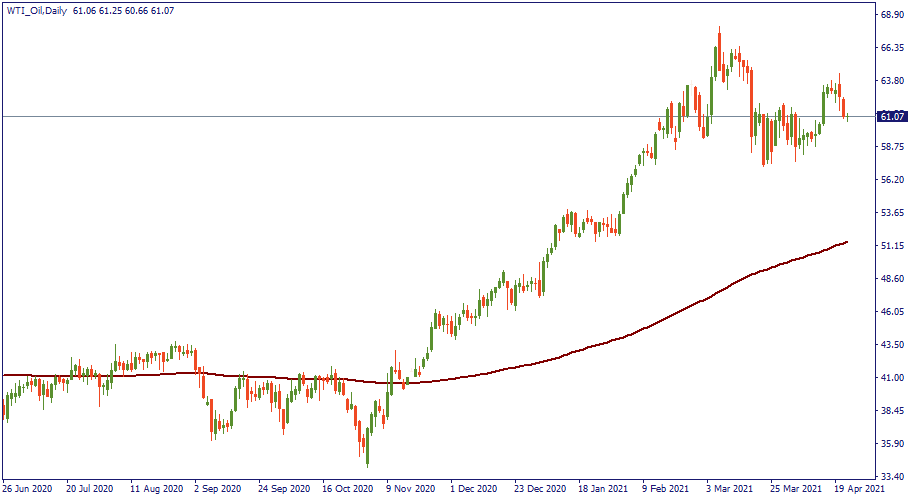

That’s one of the key meetings of the oil cartel as the previous one surprisingly revealed their plans to gradually start increasing the supply. However, OPEC+ members had agreed to meet at the end of April to review the situation and check if the global oil demand dynamics are indeed following the previous projections. If the forecasts prove to be correct and the oil supply increase plans are confirmed, that may serve as an indication that the cartel is optimistic about the current oil market dynamics. Otherwise, if the outlook doesn’t encourage optimism, OPEC+ may revise its plan for the oil supply boost.

If the OPEC+ reveals no change to its oil supply plans, it’ll be a positive sign of the global oil demand recovery. In this case, the oil price will likely stay around the same level it’s been trading at lately. A revision of the plan will likely push the price upwards as it would mean that the cartel is planning to hold the increase in the supply quantities.

Instruments to trade: WTI oil; Brent oil