Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaUS consumer price indexes (CPI) will be announced at 15:30 MT (GMT+3) on Wednesday, August 11.

The headline indicator presents the price change of goods and services purchased by consumers. The core indicator is based on the same data excluding food and energy, as prices of these goods are highly volatile. The indexes are based on the average price of various goods and services that are sampled and then compared to the previous sampling. Traders and investors look closely at these data as consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices make the central bank raise interest rates.

Last time the actual result was higher than expected, and USD gained 0.71% versus the EUR.

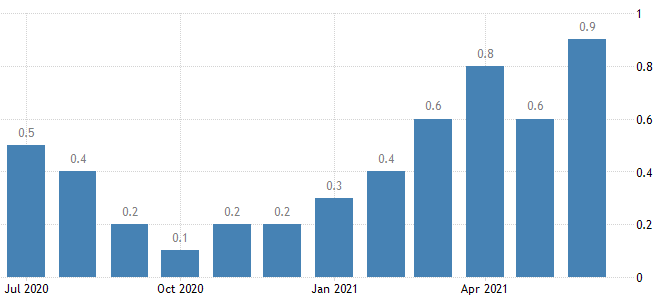

Consumer price index

Instruments to trade: EUR/USD, USD/CAD, AUD/USD.