Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe RBA Rate Statement comes on June 1, at 07:30 GMT+3.

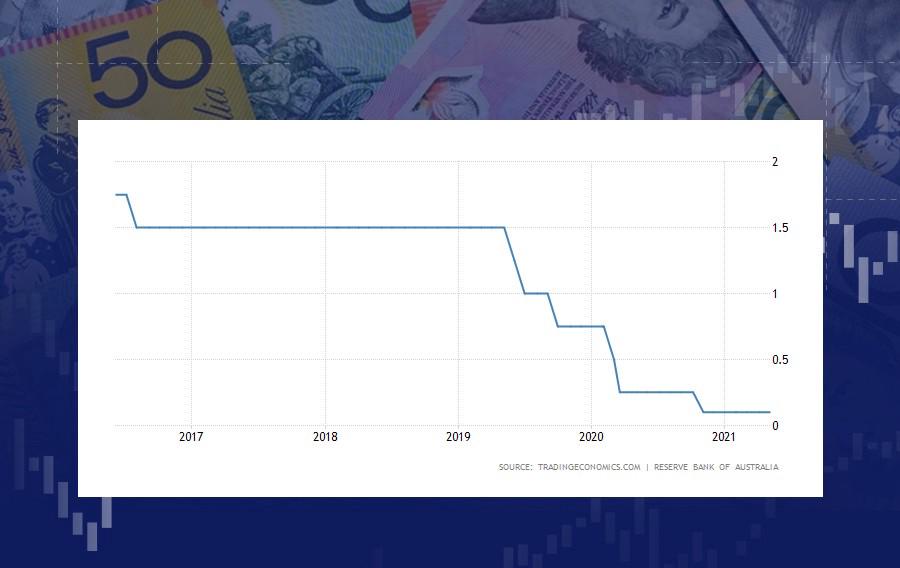

The Reserve Bank of Australia kept the rate steady at 0.1% during the last session. It’s planning to keep it there unless and until the actual inflation reaches 2-3% and the labor market corrects to maximum employment. Generally, the bank is committed to maintaining the financial conditions in the country as supportive as possible to ensure nothing stands in the way of the economic recovery.

We don’t trade the rate itself as it’s likely to be kept unchanged. Rather, we’re going to trade the details of the Monetary Policy that the RBA will share. Generally, if they are largely optimistic, the AUD is likely to rise. Otherwise, a weak domestic economic outlook may press on the Australian dollar.

Instruments to trade: AUD/USD, AUD/CHF, AUD/NZD, AUD/JPY