Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

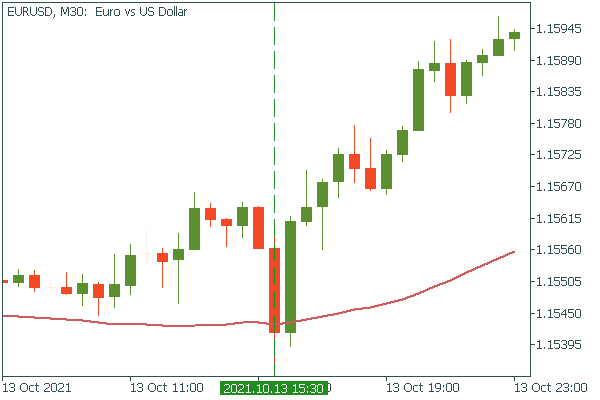

Personal areaThe US Inflation Rate (CPI) will be released on Wednesday, November 10, at 15:30 MT (GMT+2). This indicator measures the month-over-month change in the price of goods and services. The inflation report will affect the US dollar and thus almost the entire Forex market.

The Federal Reserve makes policy decisions based on the Inflation Rate data, that’s why not only the actual report but also traders’ expectations for the Inflation Rate release increase volatility in the Forex market.

The last report showed that inflation was 0.4%, which was better than the expected 0.3%. As a result, EUR/USD dropped by 140 points. Pay attention that EUR/USD falls when the USD rises, and vice versa, EUR/USD rises when the USD falls. Besides, take into consideration the trend and strong support levels. On the day of the release, the pair was trending up and when it met the 50-day moving average (the red line) it reversed up.

Compare the actual Inflation Rate with the market forecast. The forecast tends to appear a few days before the release in the economic calendar. The strong Inflation Rate report can force the Fed to raise rates earlier than expected. It should push the USD up. Here’s the rule below, but remember that every rule has exceptions sometimes!

Instruments to trade: EUR/USD, USD/JPY, all other majors, and also gold (XAU/USD).