Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe FOMC, a committee within the Federal Reserve, will hold an important meeting and press conference on September 22 at 21:00 MT time (GMT+3). FOMC’s comments will hugely affect the US dollar and thus all the pairs with the USD and US indices such as S&P 500 (US500), Nasdaq (US100), etc. This committee will discuss what time to start reducing bond buys and hiking interest rates.

All the market participants are waiting eagerly for this moment as it will bring volatility to the markets. However, most analysts don’t expect any hawkish moves from the Fed this time as the US Inflation Rate came out lower than expected and it can ease pressure on the Fed.

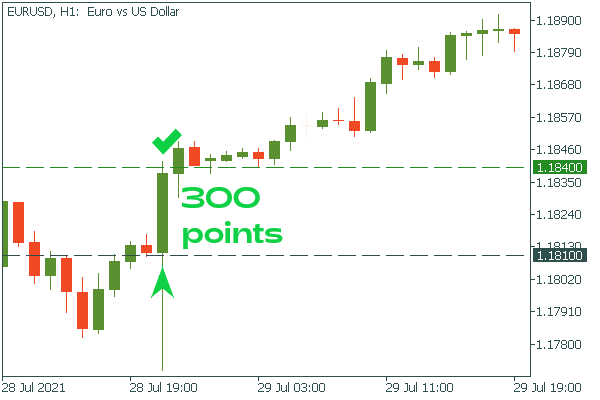

Last time, the Federal Reserve was dovish. Therefore, the USD weakened and EUR/USD surged by 300 points only in 1 hour! After that, EUR/USD continued rising further as the Fed meeting has a long-term effect on the markets.

Instruments to trade: EUR/USD, GBP/USD, XAU/USD, US500.