Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD keeps moving inside the descending channel. Yesterday, the US inflation jump pushed the USD up and thus pressed EUR/USD down significantly. Today, the pair is recovering the losses. It may rise to the 50-period moving average (MA) of 1.1835, but shouldn’t cross it on the first try. If it manages to do so, it may soar to the 100-period MA of 1.1880. Support levels are yesterday’s low of 1.1770 and 1.1750.

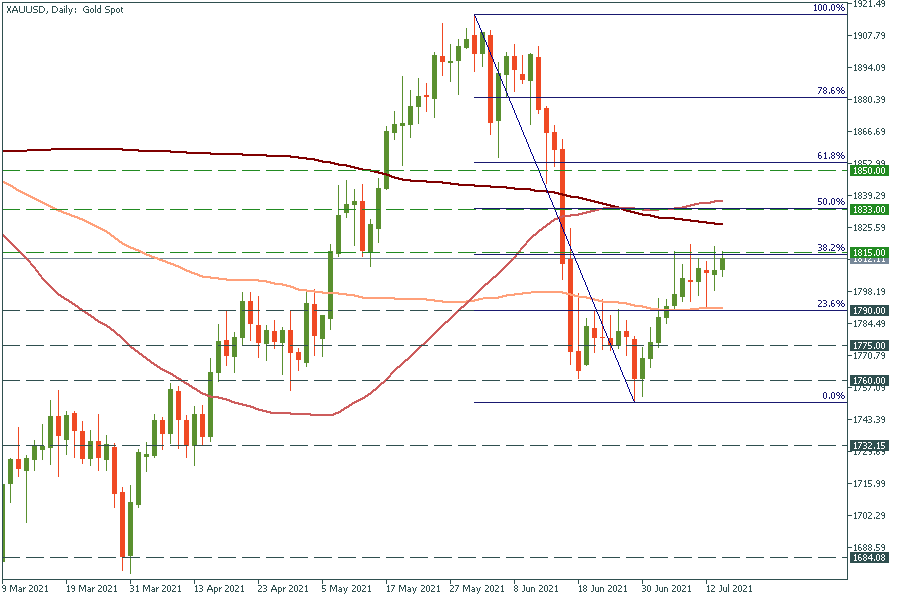

Gold keeps attacking the 38.2% Fibonacci retracement level of $1815. If the price jumps above this threshold, it should rise to the 50% Fibo level of $1833. It may happen as the US dollar is quite weak today. On the flip side, if gold fails to cross the $1815 barrier, it will drop to the 23.6% Fibo level of $1790.

NZD/USD surged above the psychological mark of 0.7000 due to RBNZ’s hawkish surprise. The pair is likely to rise to the 200-day moving average of 0.7070, where it should stop for a while. The breakout above the 200-day MA will push the pair up to the next round number of 0.7100. Support levels are 0.7000 and yesterday’s low of 0.6930.