Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

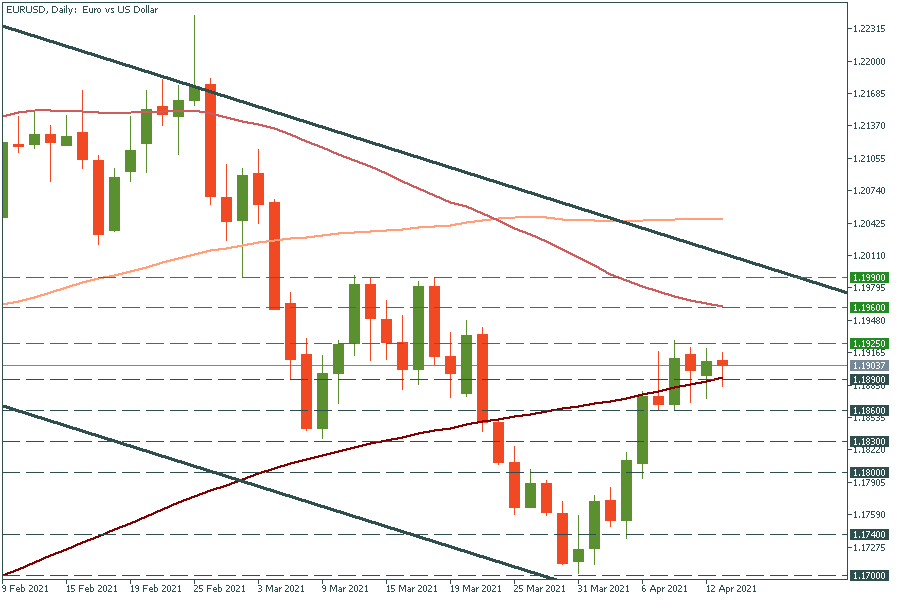

Personal areaIf EUR/USD manages to break 1.1925, the way up to the 50-day moving average of 1.1960 will be open. On the flip side, if it crosses the 200-day moving average of 1.1890, it may fall to the low of April 7 at 1.1860. Upcoming US inflation data will define the movement of the pair. Ahead of that, it may move sideways.

Gold has approached the significant support level of $1724. The move below will drive the yellow metal to the key psychological mark of $1700. Besides, the strong USD is likely to press gold down. But if US sales are worse than the forecasts, the dollar will weaken and gold will rise. The move above $1745 will push the pair higher to the key resistance level of $1760.

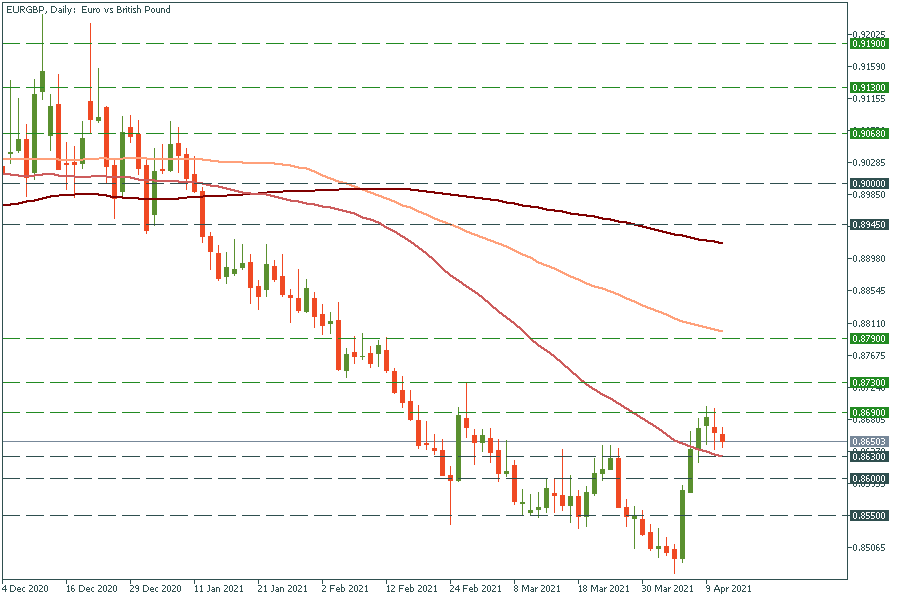

Dollar, dollar, let’s discuss something different! For instance, EUR/GBP. There is a really interesting situation. The pair was falling from the start of the year but then reversed to the upside last week. Perhaps it’s the beginning of the new trend. Now it’s falling to the 50-period moving average of 0.8630. If may bounce off it and retest the recent high of 0.8690. The move above it will drive the pair up to the high of April 26 at 0.8730.