Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

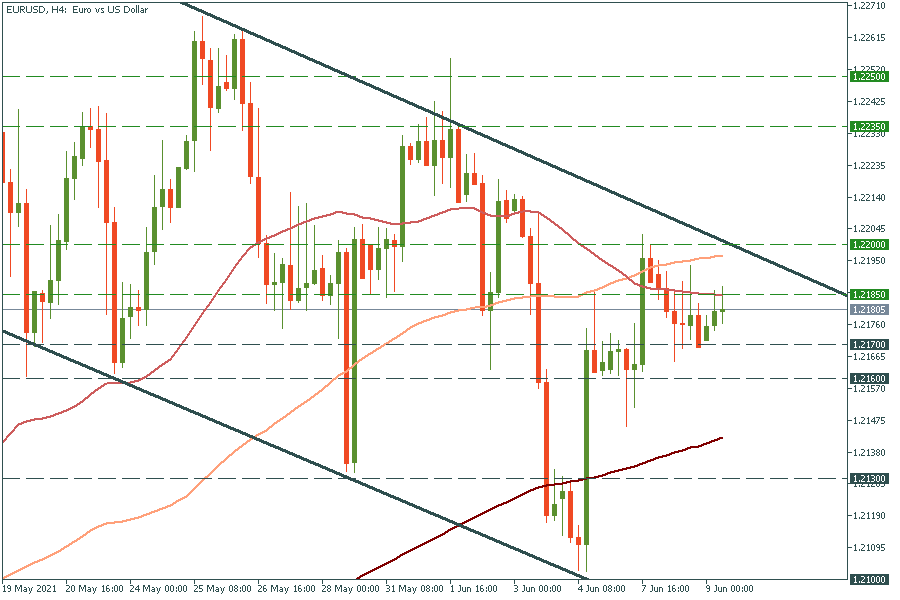

Personal areaThe most-traded pair in the Forex market is moving inside the descending channel. The move below yesterday’s low of 1.2170 will press the pair down to Monday’s low of 1.2160. On the flip side, if it manages to break above the 50-period moving average of 1.2185, it will rally up further to 1.2200.

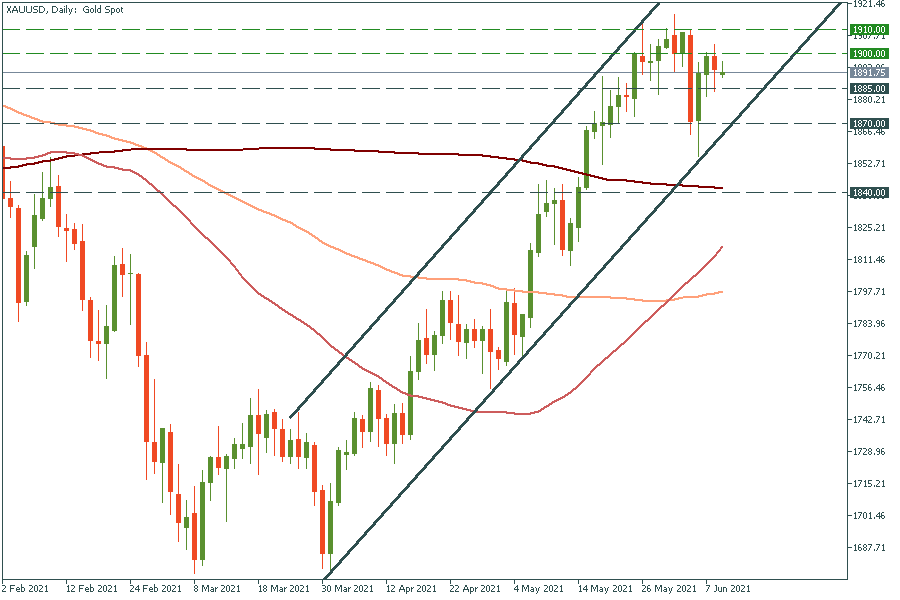

XAU/USD is trending up but has failed to cross the psychological mark of $1900 so far. If it manages to break the resistance zone of $1900-1910, it may surge to January highs of $1950. Support levels are at the recent lows of $1885 and $1870.

The Canadian dollar gained after the Bank of Canada cut asset purchases. If the bank hints at more tapering in July Durant today’s meeting, the USD/CAD could fall even more and break the support level of 1.2000. If it does so, the way down to the next round number of 1.1900 will be open. Resistance levels are at the recent highs of 1.2150 and 1.2200.