Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOPEC members haven’t been able to agree on oil output yesterday. Saudi Arabia and Russia agreed initially to boost output 400,000 barrels a day from August, but the United Arab Emirates blocked a deal. The meeting will continue today. If OPEC+ can’t reach an agreement, it raises the possibility that crude will surge higher. Even if members agree on the output increase, the implementation of the agreement would depend on US-Iran nuclear talks. Brent oil went above $75.50, WTI oil passed $74.50.

XBR/USD (Brent oil) is at the highs unseen since 2018. If it breaks above $76.00, it will rally up further to yesterday’s high of $76.50. Support levels are at the psychological mark of $75.00 and the 50-period moving average of $74.70.

The US dollar jumped ahead of the NFP report today. Investors expect an increase of 700,000 jobs in June, above May's 559,000. The better the NFP outcome – the more chances the Federal Reserve might start tapering stimulus, which in turn will push the USD up.

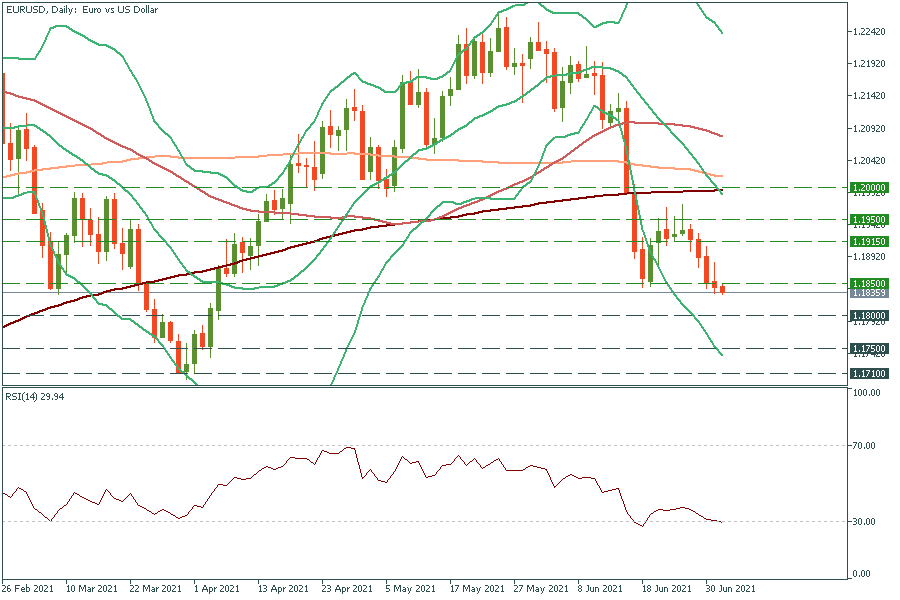

EUR/USD has broken below the 1.1850 support and edging lower to the psychological mark of 1.1800. The RSI indicator is at the 30.00 level, signaling the euro is oversold, but if NFP beats estimates, EUR/USD will fall further. Resistance levels are at 1.1850 and 1.1900.

Gold has recovered some losses, but still moves without any clear direction. If it jumps above the upper line of Bollinger Bands and the RSI indicator moves above 65.00, gold is likely to drop. Gold has failed to cross the key resistance of $1790 several times already and thus XAU/USD is likely to reverse down from it again. Support levels are $1765.00 and $1755.00.

Speaking about stocks, Johnson & Johnson claimed its vaccine neutralizes the fast-spreading Delta virus variant. Check out the Johnson & Johnson stock when the stock market opens at 16:30 GMT+3.