Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaNFP Will Choose the Direction for USD and Gold

United States Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on November 5, 14:30 GMT+2.

United States Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on November 5, 14:30 GMT+2. Millions of eyes watch these data closely because it shows us the overall economic health. Average hourly earnings are the earliest data related to labor inflation. NFP and unemployment rate help to understand overall economic health, thus, predict future Fed’s readings result.

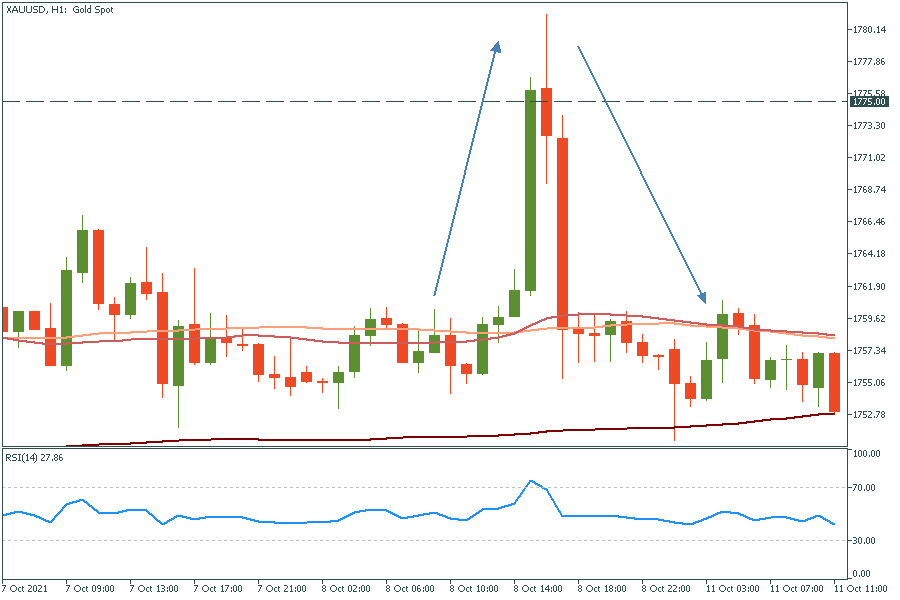

All three readings are important because they are released monthly, making them pretty accurate indicators of the current state of the economy. However, last month didn’t result in big swings in the price of related assets. Gold, which is usually affected by the data because of the USD reaction (these assets have inverse correlation), made a big volatile move, but only for an hour. A little bit later everything went back to normal. It is still a reaction we can trade on and it is interesting to see the price movements this time.

This data will make a great impact on different assets, including gold, USD-related pairs, and the stock market, especially S&P 500 index.

Instruments to trade: XAU/USD, EUR/USD, USD/CAD.