Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

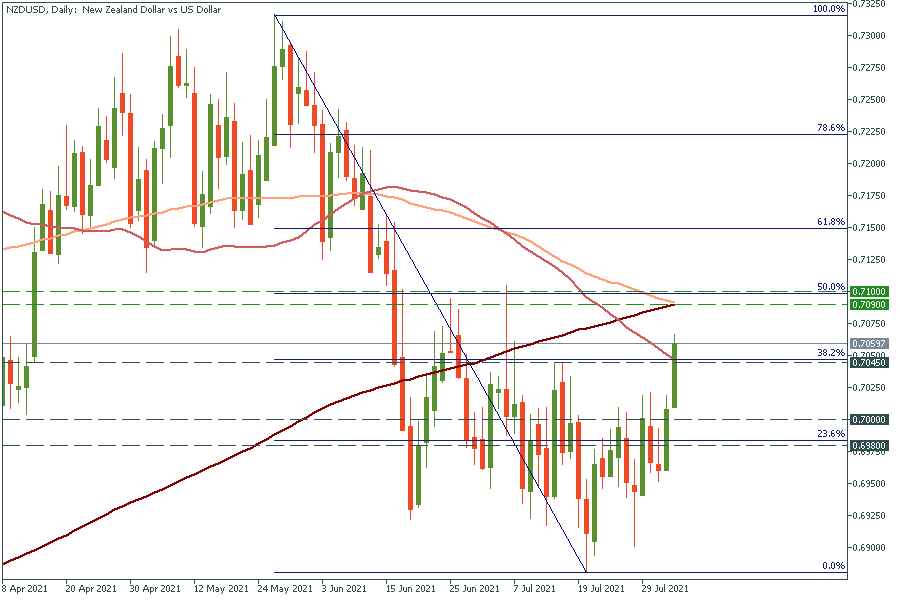

Personal areaNZD/USD has jumped above the 38.2% Fibonacci retracement level of 0.7045. Thus, it’s more likely to rise till the 50.0% Fibonacci retracement level of 0.7100, but the pair may stop rising earlier –near 0.7090, where also the 100- and 200- day moving averages lie. Support levels are 0.7045 and 0.7000.

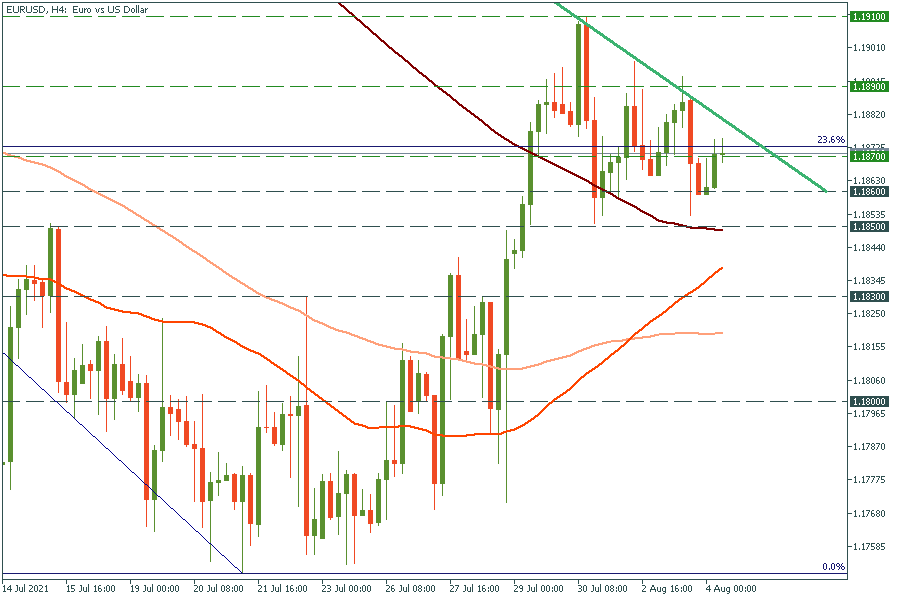

EUR/USD is attacking the 23.6% Fibonacci retracement level of 1.1870. The upper resistance line may become an obstacle for the pair, that’s why we might expect a reverse down. If it happens, it may fall to the recent low of 1.1860 and then even to the 200-period moving average of 1.1850.

S&P 500 (US500) is likely to reverse down from the upper line of Bollinger Bands at 4430 as the pair has failed to cross this resistance level several times already. If it reverses down, it may fall to the midline of Bollinger Bands which coincides with the 50-period moving average of 4405. The pair is likely to stop falling at this level.