Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaEUR/USD is moving inside the descending channel. The pair keeps attacking the 1.1800 resistance level but to no avail. Besides, the trendline and the 50-period moving average are strong barriers which the pair will struggle to break. Thus, we might expect a reverse down from the current levels. On the way down, EUR/USD may meet support levels at 1.1770 and 1.1750.

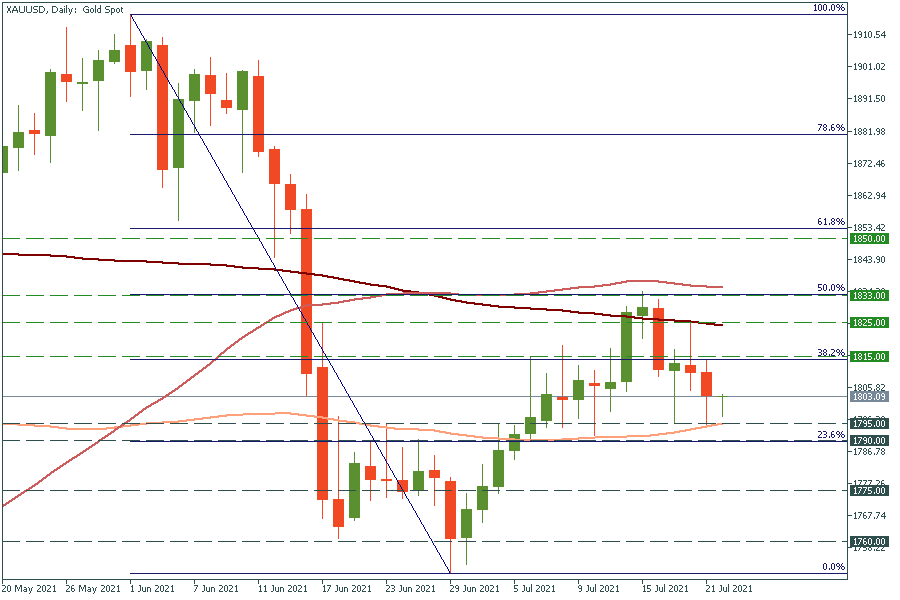

XAU/USD has reversed up after touching the 100-day moving average of $1795. The chain of long lower tails tells us that the price was rejected at the support zone of $1790-1795. Thus, we might expect gold to rise to the 38.2% Fibonacci retracement level of $1815 today, but the current momentum is weak and we should wait for some time. In the opposite scenario, if gold breaks below the support zone of $1790-1795, it will fall to the next round number of $1775.

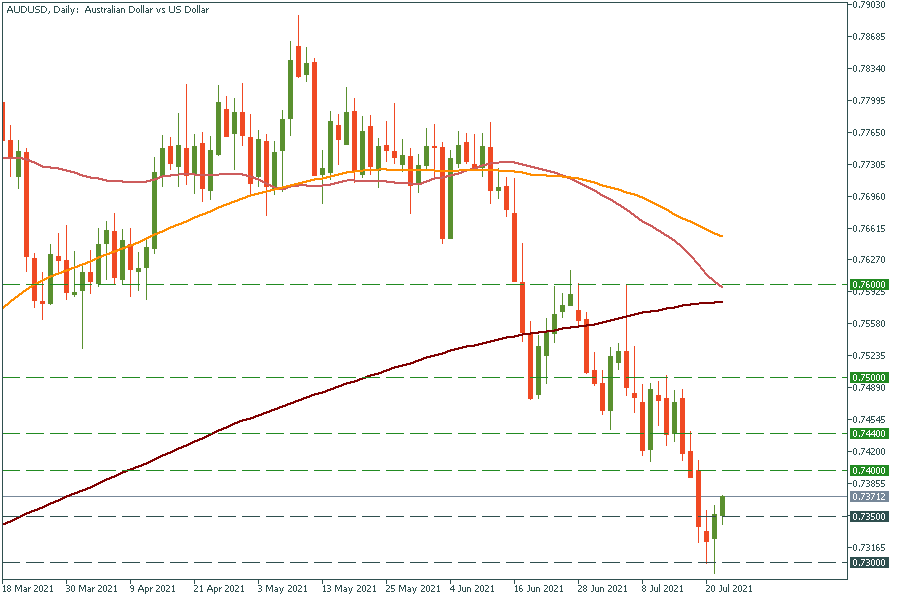

It’s a really interesting movement in the AUD/USD pair. The pair has reversed up from the 0.7300 support level and the last two green candles signal us that the bullish momentum is strong and the rally up may continue till 0.7400. If the pair manages to break it, it may jump to the high of July 16 at 0.7440.